Every resident welfare association depends on invoices to keep the community running. Maintenance charges, water bills, parking fees, utility costs, vendor payments and penalties all flow through this one process. If invoicing is delayed or inaccurate, societies struggle with cash flow, vendors refuse to work without timely payments, and audits expose gaps that damage credibility.

Most committees use spreadsheets or basic accounting software, which leaves too much room for mistakes. A wrong GST number, an inconsistent invoice format, or a missing HSN code can trigger disputes and lead to wasted hours. When batches of invoices are generated without verification, errors spread across hundreds of flats. Correcting them later is messy, with manual adjustments and poor audit trails.

This is where Mygate ERP’s invoicing module comes in. It treats invoicing not as a one-click action, but as a structured workflow. Committees can design templates, configure billing rules, generate invoices in draft, verify them in bulk, and only then publish them. Once published, the system takes care of GST validations, e-invoice generation for eligible flats, notifications to residents, and automatic posting to ledgers.

Table of Contents

What sets Mygate ERP invoicing apart

Mygate ERP does not simply issue bills. It builds guardrails around the process. These guardrails prevent common mistakes and give treasurers better control. Some of the unique aspects include:

-

- Draft and review before publish: Invoices can be generated and held in draft until committees verify them with Excel or PDF exports.

- Side-by-side template preview: While configuring invoice templates, a live preview window shows exactly how the final invoice will appear.

- Multiple invoice types: Normal invoices, proforma invoices, group invoices and opening balance invoices are supported, so different billing needs are covered.

- Penalty slabs and arrears modes: Penalties can be fixed, percentage-based or daily interest, while arrears can be consolidated or bifurcated.

- Non-member and ad-hoc billing: Charges can be raised for non-residents or one-time services outside regular cycles.

- GST and IRN integration: The system connects with the GST Suvidha Portal to generate IRNs and QR codes automatically after publish.

- Audit trail and reporting: Every action, from template edits to batch reversals, is logged and available for year-end audits.

Preparing the system before invoicing

Before a society can generate its first invoice on Mygate ERP, a set of one-time configurations must be completed. These are not cosmetic settings. They form the foundation for GST compliance, resident communication, and ledger accuracy. If these steps are skipped or done casually, problems will appear later in the form of failed IRN requests, mismatched balances or incorrect arrear calculations.

At the society level, the finance admin needs to:

-

- Enter the society GSTIN, registered legal name, address, pincode and state. These details must exactly match what is registered on the GST portal.

- Register the society as an API user on the GST Suvidha Portal and share the API ID and password with Mygate. The system will test these credentials before enabling e-invoicing.

- Define invoice sequences. Mygate enforces character limits on invoice sequence prefixes because the GST portal will reject long strings. Sequences must be locked and should not change mid-year.

- Map the beneficiary bank account ledger. This ensures payments against invoices are posted to the right bank account.

- Set up an advance ledger where overpayments or pre-payments will be recorded.

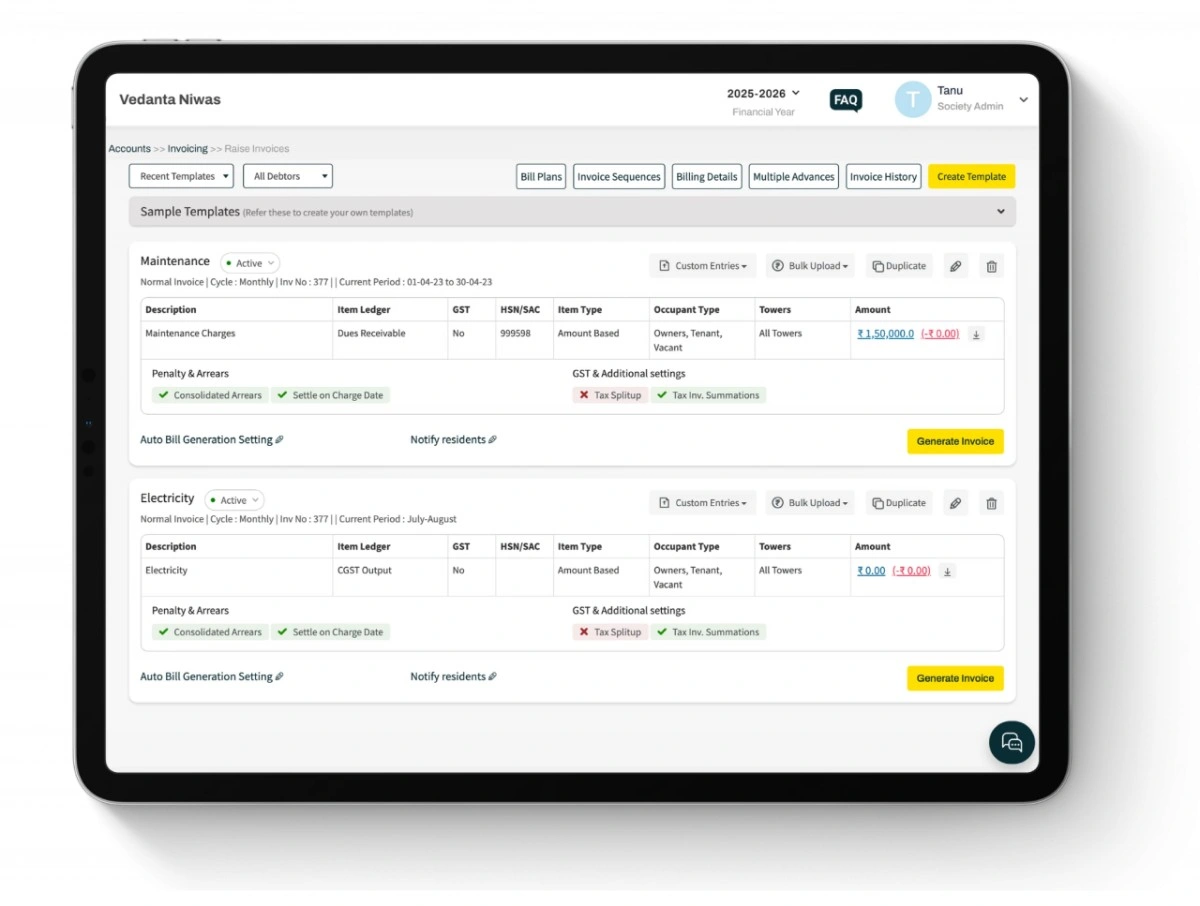

Raise invoices across categories.

Creating invoice templates

Templates are the backbone of invoicing in Mygate ERP. A template is more than just a format. It binds together the charge items, the cycle, the bank details, and the ledger mapping. Templates also act as the control point for penalties, arrears and GST logic.

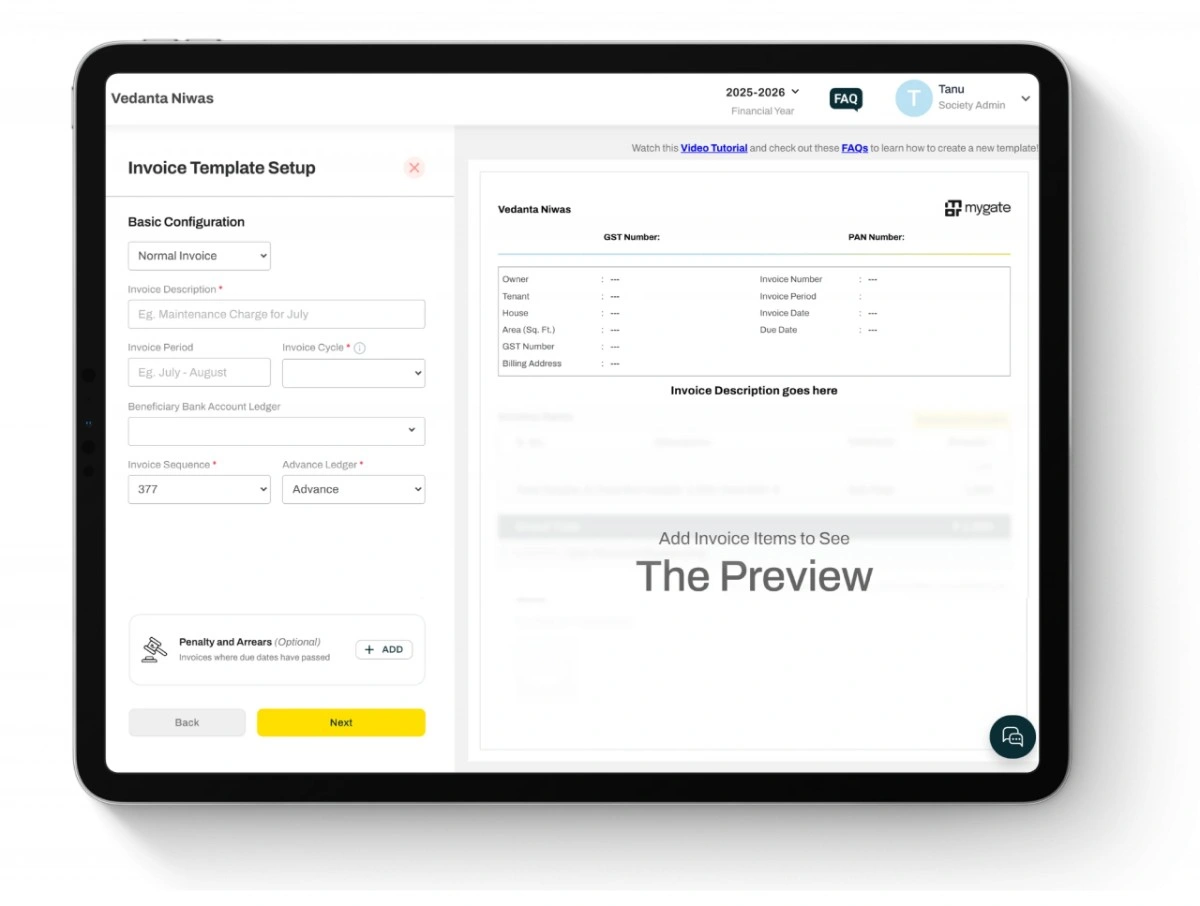

Inside Accounts → Invoicing → Invoice Template Setup, the admin fills in:

- Invoice type: choose from normal, proforma, opening balance or group invoice.

- Invoice description: for example, “Maintenance Charges for August 2025.”

- Invoice period and cycle: define the coverage dates and recurrence.

- Beneficiary bank account ledger: payments will post here automatically.

- Invoice sequence: prefix and next number, restricted to GST-compliant length.

- Advance ledger: to manage excess payments and settlement rules.

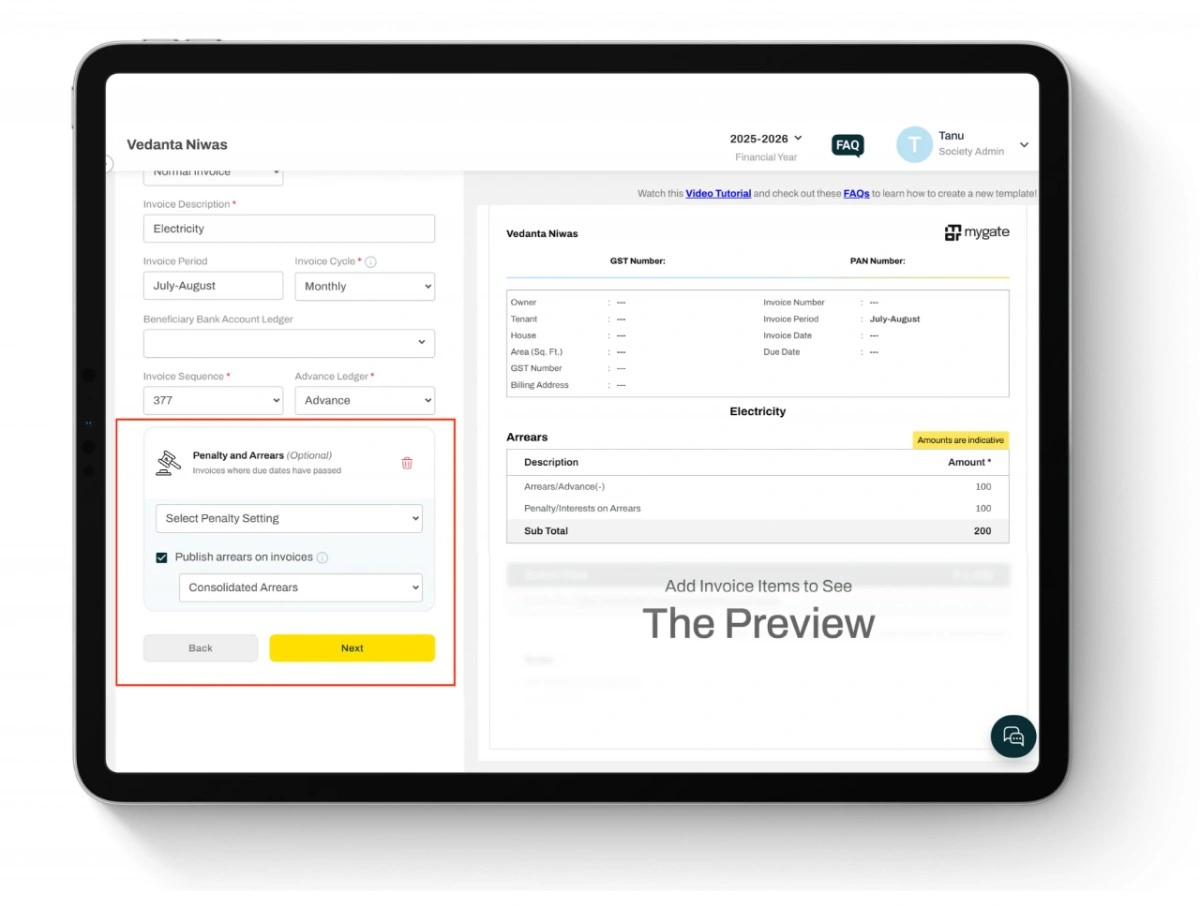

- Arrear handling: choose between consolidated arrears, bifurcated arrears or settlement at charge date.

- Penalty setting: link to an existing penalty rule if applicable.

Set up invoice templates with a side-by-side preview to see changes in real time.

On the right, the preview window updates in real time to show how the invoice will appear. This side-by-side view is critical. It lets committees spot header mistakes, missing GST details or formatting errors before saving.

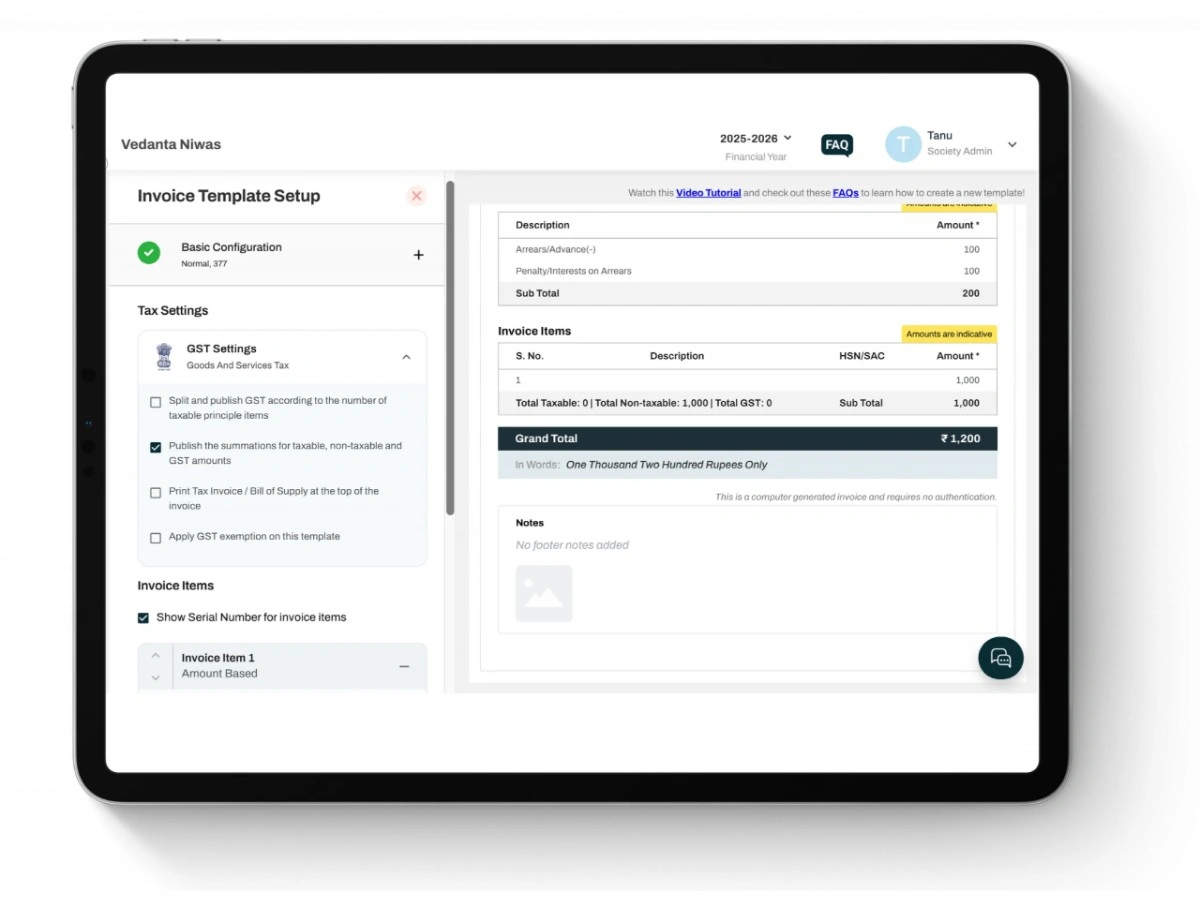

Configuring items inside templates

Each invoice template is built on a set of items. Items represent charges such as maintenance, water charges, parking or sinking fund. Every item requires:

-

- A description that appears on the invoice line.

- The ledger it maps to in accounts.

- GST applicability (yes or no).

- The HSN or SAC code, mandatory for e-invoicing.

- An item type, which determines how the charge is calculated.

- Occupant type and tower filters, to apply charges only to relevant flats or residents.

Apply GST settings directly in your invoice template, with options for split, exemption, and summaries.

Item types explained

Mygate supports three item types, each designed for a different billing logic:

-

- Amount based: a flat amount applied to each unit. Ideal for clubhouse subscriptions or fixed charges.

- Area based: the system multiplies a per-sqft rate by the unit area recorded in the house master. This is commonly used for maintenance charges.

- Meter based: the charge is calculated from utility meter readings. Readings can be uploaded in bulk or entered manually. This is typically used for water or electricity charges.

Why setup and templates matter

Templates and item definitions are not one-time paperwork. They are the guardrails that determine how accurate and consistent every invoice will be. A poorly designed template means recurring disputes, messy credit notes and audit failures. A well-structured template means invoices can be generated and published with confidence, month after month, without manual corrections.

Why billing logic needs attention

Once templates are set, the next step is defining how charges behave across billing cycles. This is where penalties, arrears, discounts and settlement rules come into play. These are not cosmetic adjustments. They directly shape how residents perceive fairness, how quickly dues are recovered, and how auditors judge compliance. Mygate ERP gives committees several options, but the system enforces structure so that decisions are recorded, consistent and visible in reports.

Arrears handling

Arrears are the unpaid amounts from previous cycles. Mygate ERP lets committees decide how these arrears appear and how they are carried forward:

- Consolidated arrears: all previous dues are shown as one combined figure on the new invoice.

- Bifurcated arrears: dues are split and displayed under the original charge heads. Residents can see what portion comes from maintenance, water charges, penalties, and so on.

- Settlement on charge date: arrears are posted based on the charge date instead of the invoice date. This is useful when societies want more precise allocation of dues.

This flexibility matters because some societies prefer simplicity, while others prefer transparency. Either way, the arrear logic is baked into the template so it stays consistent across cycles.

Publish arrears and penalties on invoices with ease.

Penalty settings

Late payment penalties are often the most contested charges in a society. Mygate ERP supports detailed penalty configurations through Accounts → Invoicing → Penalty Setting. Committees can create a penalty rule once and link it to templates.

Penalty options include:

- Fixed penalty: a flat amount charged once the due date is missed.

- Percentage penalty: a percentage of the outstanding amount added after the due date.

- Daily interest penalty: a running penalty that increases daily until dues are cleared.

Penalty slabs can also be created, for example:

- ₹500 for dues up to ₹5,000

- ₹1,000 for dues between ₹5,001 and ₹10,000

- A daily rate for dues above ₹10,000

Each penalty setting allows you to define thresholds, frequency and limits. This ensures penalties do not spiral out of proportion and that rules are transparent to residents.

Discounts and waivers

Mygate ERP also allows committees to grant discounts. Unlike manual reductions, discounts are logged in a discount register, which records:

- The resident or flat that received the discount

- The amount reduced

- The committee member who authorized it

- The date and reason for approval

This register becomes part of the audit trail. Instead of informal adjustments, discounts are structured and accountable.

Multiple advances and settlement rules

Overpayments and pre-payments are common in societies. Residents sometimes pay extra for convenience or in advance of travel. Mygate ERP directs these amounts into an advance ledger, which is defined in the template. The system can then auto-settle advances against new invoices. Committees can choose whether advances settle on the invoice date, on the due date, or on the current date. This prevents confusion where advances are either applied too soon or not applied at all.

Why this matters for governance

When arrears, penalties and discounts are manually applied, residents often complain of bias and auditors highlight inconsistencies. By codifying these rules inside Mygate ERP, committees protect themselves. Residents can argue about policy, but not about execution, because the system enforces the rules automatically.

Why draft and publish are separate

In most software, the moment invoices are generated, they are considered live. Residents are notified, payments are enabled, and any error has to be corrected through manual adjustments. Mygate ERP deliberately separates generation from publishing. This two-step process gives committees the space to review, verify, and correct before residents see the bills or before GST IRN requests are fired.

Draft mode is not optional. It is a safeguard that ensures errors can be caught upstream. Once you publish, invoices become part of the financial record, so reversals and credit notes are the only way to make changes.

Generating invoices in draft

When you raise invoices from a template, you have the choice to publish now or publish later. Choosing publish later keeps the invoices in draft. Draft invoices are stored under a batch ID in the Invoice History screen.

What happens in draft:

-

- Invoices are created and stored, but residents cannot see them.

- Payments are not enabled.

- IRN requests are not sent to the GST system.

- Advances are not applied.

This makes draft mode the safe space for verification.

Verifying drafts in bulk

Verification is not done invoice by invoice. Mygate ERP gives committees several tools to review entire batches at once.

Available checks include:

- PDF download: view a sample or all invoices in the batch to confirm layout and calculations.

- Excel download: export the batch in a spreadsheet to check totals, arrears and penalty applications flat by flat.

- MIS reports: compare opening and closing balances, billed amounts and penalties at the society level.

- Dues reports: view total dues per house after the batch is generated.

These reports should be treated as part of the audit trail. Committees should always store at least one verification export as proof that bills were checked before publishing.

Correcting errors before publish

Draft batches can be corrected in two ways:

- Reverse the entire batch: If a configuration error affects many flats, the batch can be deleted and regenerated with corrected settings.

- Regenerate selected invoices: If only a few flats have errors in their data (for example, missing GSTIN or wrong meter reading), update those records and regenerate just for those flats.

Using drafts this way avoids messy credit notes later.

Publishing invoices

Once a batch is verified, it can be published. Publishing is the decisive step. At this stage:

- Residents are notified through the app and email.

- Payments are enabled.

- For B2B flats, IRN requests are sent to the GST Suvidha Portal.

- Advances and overpayments are applied according to the template rules.

From this point, the invoices are official. Corrections can only be made by issuing credit notes or, in some cases, reversing entire published batches.

Auto-publish as a safeguard

Mygate ERP also includes an auto-publish safeguard. If a batch is generated in draft and forgotten, the system can automatically publish it at the scheduled cut-off time. This ensures invoices are not left in limbo and residents do not miss billing cycles.

Why this flow matters

By splitting generation and publishing, Mygate ERP prevents small mistakes from turning into large disputes. Committees are given a structured window to check totals, verify penalties, and confirm arrears before making invoices live. This reduces resident complaints, cuts down credit note usage, and builds confidence in the fairness of billing.

E-Invoicing and IRN Lifecycle

Why e-invoicing is different from regular invoicing

For many societies, raising maintenance bills or vendor invoices is a simple internal process. But once GST came into effect, societies that fall under compliance rules also need to issue e-invoices through the government’s Invoice Registration Portal (IRP). These invoices are not just PDFs with a GST number. They must include a unique Invoice Reference Number (IRN) and a scannable QR code generated by the GST system.

Mygate ERP integrates directly with the IRP. Once an invoice is published, the system automatically sends the data to the GST portal, receives the IRN, and attaches it to the invoice record. This ensures every B2B invoice is both compliant and traceable without extra manual steps.

Prerequisites for e-invoicing

Before IRN generation will work, societies must complete certain prerequisites:

-

- GST API registration: The society must register as an API user on the GST portal and obtain login credentials. Mygate uses these credentials to send IRN requests.

- Seller profile: The society’s GSTIN, legal name, address, pincode, and state must be updated inside Mygate ERP and match government records.

- Buyer details: For every B2B flat or vendor, the GSTIN, billing address, pincode, and place of supply must be recorded. The system validates these fields before sending invoices to the IRP.

- HSN codes: Each invoice item must have an HSN or SAC code, even if it is non-taxable. Missing HSN codes will cause IRN requests to fail.

What happens during IRN generation

When a batch of invoices is published:

- Mygate formats the invoice data according to GST schema.

- It sends the data to the IRP using the society’s API credentials.

- The IRP validates the invoice and, if successful, generates an IRN and QR code.

- Mygate saves the IRN and QR against the invoice record and updates the invoice PDF.

- The resident or vendor receives the invoice with the IRN included.

This entire process happens in the background and usually takes a few seconds per invoice.

Tracking IRN status

Mygate provides an E-Invoices tab inside Invoice History. This tracker is the committee’s control center for compliance. It shows:

- Invoice number and flat or debtor name

- Request type (generation, cancellation, regeneration)

- Request status (success, pending, failed)

- IRN number and QR code if generated

- Date and time of request

Filters allow committees to narrow down by house, status or date range. This is where admins should check if any invoices have failed IRN generation.

Handling IRN failures

If an invoice fails to generate an IRN, Mygate does not leave it unresolved. The system logs the failure and allows admins to retry after fixing the data. Common causes include:

- Buyer GSTIN not found or invalid

- Address exceeding 100 characters

- Incorrect pincode and state combination for place of supply

- Missing HSN code on an item or penalty line

Once the data is corrected in the buyer profile or item settings, the invoice can be re-submitted to the IRP.

Cancellation rules

The government strictly limits IRN cancellations. Mygate enforces these rules to prevent invalid reversals:

-

- IRNs can only be cancelled within approximately 24 hours (23 hours 58 minutes is the safety buffer).

- After the cancellation window closes, the invoice cannot be deleted. The only option is to issue a credit note.

- If a batch contains invoices with IRNs, Mygate disables hard deletion of that batch. This ensures declared invoices remain traceable.

Credit notes and reversals

When corrections are required after publishing, committees should use credit notes. Each credit note is automatically linked to the original invoice, so the audit trail remains intact. Mygate ensures both documents stay visible in reports, making it clear that an invoice was reversed properly.

Why this lifecycle matters

Societies that fall under GST compliance cannot treat invoices casually. A missing IRN or an invalid cancellation can expose the committee to penalties during audit. Mygate ERP removes much of this risk by embedding validations and strict workflows. Committees do not have to remember GST rules for every invoice. They only need to keep their master data clean and follow the draft, verify and publish process.

Why special cases need their own attention

Most societies only think of monthly maintenance when they think of invoicing. In reality, committees often need to bill for events, one-time services, or penalties that do not follow the normal cycle. Mygate ERP covers these scenarios so committees do not have to step outside the system into spreadsheets or manual invoices. Handling these cases inside ERP keeps every financial transaction part of the audit trail.

Non-member invoicing

Societies sometimes provide services to non-residents. This could include:

- Renting out the clubhouse for private events

- Charging vendors for advertisements or stalls inside the society

- Collecting fees for external use of amenities

Mygate ERP lets admins create non-member profiles. Each non-member profile stores name, contact details, billing address and GSTIN if applicable. Once created, committees can raise invoices for them just as they would for a resident. These invoices follow the same rules, are linked to ledgers, and can also generate IRNs if GST applies.

Ad-hoc invoices

Not every charge can wait for the next billing cycle. Sometimes a flat needs to be charged separately for a repair, legal notice, or rule violation. In such cases, Mygate supports ad-hoc invoicing.

Ad-hoc invoices can be created directly from the invoicing module by selecting the flat, entering the charge description, linking it to a ledger, and adding supporting documents. These invoices can be raised instantly and remain visible in the resident’s account alongside the regular cycle invoices.

Provisional penalties

Late payment fines can be handled in two ways. Some societies prefer to only recognize penalties once they are collected. Others prefer to recognize them as soon as they are due. Mygate ERP supports both approaches.

- Receipt-based conversion: penalties remain provisional until the resident pays. Once payment is received, the penalty is converted into a tax entry and the IRN is generated if required.

- Bulk manual conversion: committees can periodically convert provisional penalties into official entries in bulk, for example at the end of a month or year.

This flexibility ensures societies remain compliant with their chosen accounting practices while still keeping penalty tracking accurate.

Proforma and opening balance invoices

Two additional types of special invoices exist:

-

- Proforma invoices: These are estimates or preliminary bills issued before a final charge is confirmed. They do not carry IRNs but can be used for planning or communication with residents.

- Opening balance invoices: These help societies migrate to Mygate ERP from other systems. Committees can record previous dues and carry them forward as part of the new ledger. This avoids starting with incomplete data.

Why special cases matter for committees

If societies try to manage non-member charges, one-time bills or provisional penalties outside the ERP, they create parallel records that are hard to reconcile. By handling them inside Mygate, everything stays within the same reporting and audit framework. Residents and non-members get uniform invoices, auditors see consistent records, and committees avoid disputes about informal charges.

Why reconciliation is critical

Issuing invoices is only half the story. The real work for committees begins when residents start paying. Without a structured reconciliation process, treasurers often find themselves juggling unmatched receipts, unidentified transfers, and disputes over whether dues have been cleared. Mygate ERP brings structure to this stage by linking payments directly to invoices and managing overpayments through advance ledgers.

How reconciliation works in Mygate ERP

All payments received through the Mygate payment gateway flow automatically into the reconciliation screen. For payments made outside the system, such as cheques or direct bank transfers, treasurers can import bank statements and let the system attempt auto-matching.

The reconciliation module checks:

- Invoice number references in online payments

- Payment references or UTR numbers in bank statement uploads

- Amount matching between the receipt and the invoice

When a match is found, the invoice is automatically marked as cleared. If no match is found, the payment is flagged as unmatched and requires manual review.

Manual reconciliation and audit logs

Unmatched payments can be resolved by manually linking them to the correct invoice. Every manual action is logged with the user’s name, date and time. This log is visible in reconciliation reports and becomes part of the audit record. By capturing who cleared which payment, the system reduces scope for disputes later.

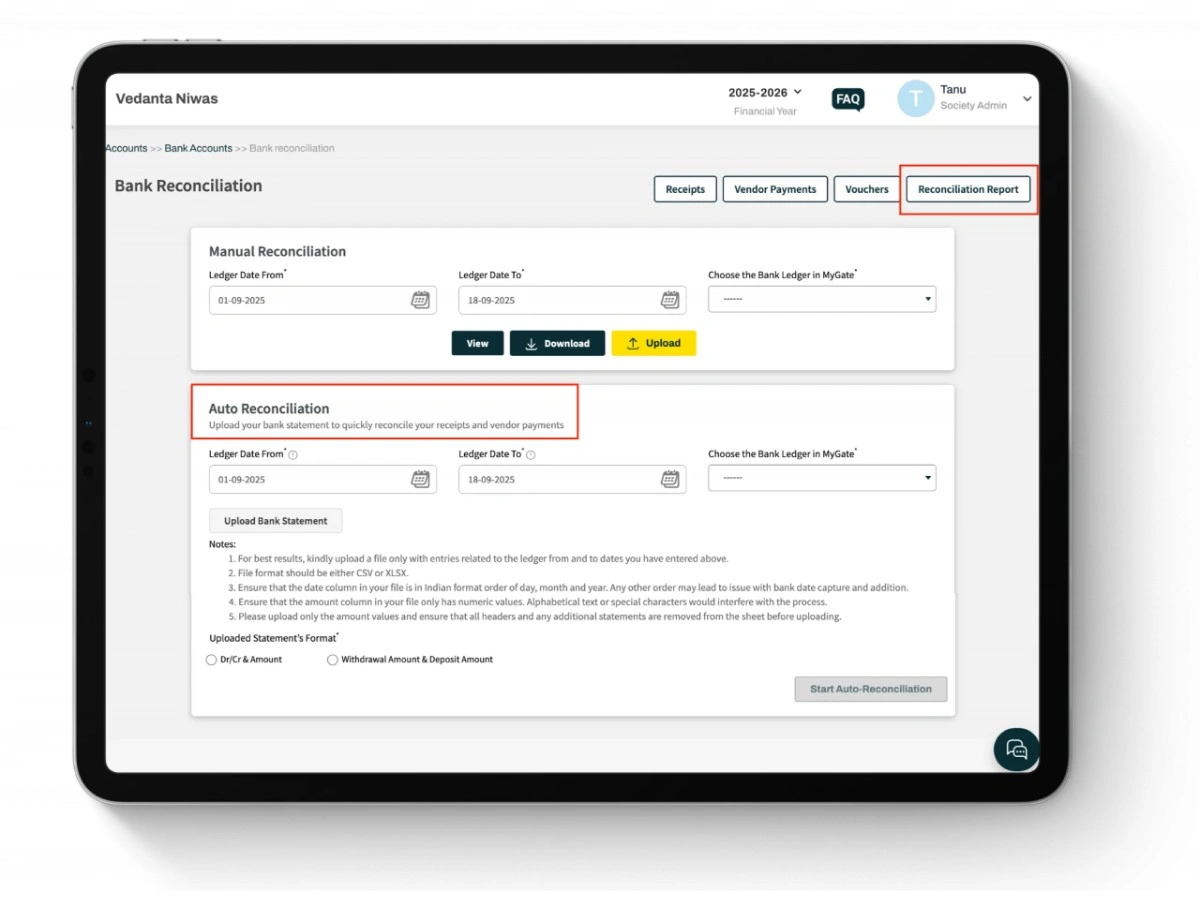

You can also auto reconcile bank statements with receipts & vendor payments.

Handling overpayments and advances

Overpayments are a common occurrence. A resident might transfer more than the invoice amount or pay several months in advance. Mygate ERP automatically moves these amounts into an advance ledger that is linked to the resident’s account.

Committees can configure how advances are applied:

- On invoice date: advances are consumed immediately when a new invoice is created.

- On due date: advances are held until the invoice due date before being applied.

- On current date: advances are applied as soon as an invoice is published.

These options give flexibility depending on how the society wants to recognize advance payments.

Multiple advances across bill plans

Mygate also supports multiple advance ledgers when different bill plans are in use. For example, a society may run one bill plan for maintenance and another for utilities. Advances can be tracked separately for each plan, ensuring clarity about which dues are prepaid.

Best practices for reconciliation

-

- Import bank statements at least weekly to avoid a backlog of unmatched payments.

- Review the unmatched payment list immediately after imports and resolve discrepancies quickly.

- Communicate clearly with residents when advances are used to adjust future invoices, so they understand how their payments were applied.

- Always store reconciliation reports alongside invoice history for year-end audits.

Why this stage matters

A well-run reconciliation process means the society’s accounts always reflect reality. Treasurers know which residents are up to date, which payments are pending, and which are in advance. Auditors see a clean linkage from invoice to receipt to ledger. Most importantly, residents have fewer reasons to raise disputes because the system provides transparency into how their payments were tracked.

Why reporting matters

For committees, raising invoices and collecting payments is only half the responsibility. The other half is proving to residents, auditors and sometimes regulators that every transaction is accurate and transparent. Without reliable reports, committees struggle to answer basic questions such as how much is overdue, which penalties were applied, or how many invoices were reversed. Mygate ERP gives societies a full reporting layer so nothing is hidden and every financial action can be traced.

Invoice History

The Invoice History section acts as the central archive of all billing activity. Every batch generated, whether published or cancelled, is recorded here. For each batch, committees can see:

- The invoice date and due date

- Number of invoices generated

- Number of active, cancelled or reversed invoices

- Linked batch ID for easy reference

From this screen, admins can also:

- Download invoices in bulk as PDFs

- Export invoice data in Excel format

- Resend invoices to residents who missed notifications

This section becomes especially valuable during audits because it shows not only the invoices that exist but also those that were cancelled or adjusted.

Penalties tab

Penalties often create friction between residents and committees. Mygate’s Penalties tab provides a transparent record of all late payment charges. Committees can filter by date range and see both accumulated penalties and those that were officially posted. This makes it clear whether penalties were provisional or converted into tax entries. It also helps during reconciliations because penalty income is visible as a separate line in reports.

E-Invoices tab

E-invoicing compliance is a sensitive area. The E-Invoices tab inside Invoice History is dedicated to IRN tracking. It shows:

- The status of each IRN request (success, pending, failed)

- The request type (generation, cancellation, regeneration)

- The IRN number and QR code if available

- Timestamps of each request

Filters allow committees to search by house, request type or date range. This tracker makes it easy to identify invoices that failed to generate an IRN so corrections can be made quickly.

Discount register

Any discounts granted to residents are captured in the discount register. This record shows the flat, the discount amount, the reason provided, and the committee member who approved it. By maintaining this log, Mygate ensures discounts do not look like arbitrary adjustments during an audit.

Dues and aging reports

Committees often need to know not only how much is unpaid but also how long dues have been pending. The aging report groups overdue invoices into 30, 60 and 90-day buckets. This helps committees identify chronic defaulters and plan collection drives. Residents can also be shown their aging summary, which makes the dues conversation more factual and less emotional.

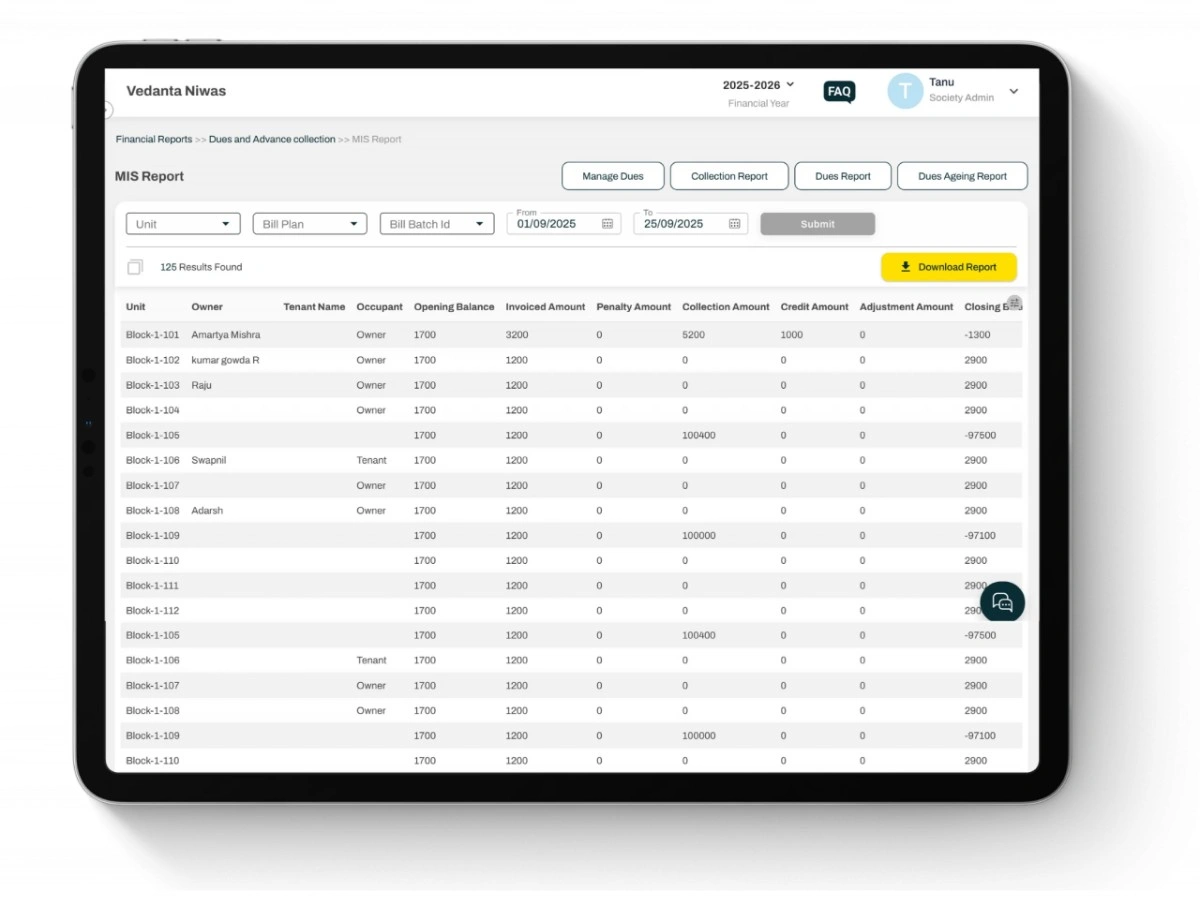

MIS reports

Mygate also provides MIS-style summaries, which combine invoiced amounts, payments received, penalties posted and advances applied into one consolidated view. These reports give treasurers and auditors a society-level snapshot rather than invoice-by-invoice detail.

Get a complete MIS report with invoices, collections, penalties, and balances in one view.

Audit exports

At year-end, committees can generate a complete audit export. This export can include:

- Invoice PDFs with IRNs and QR codes

- Excel summaries of all invoices generated and cancelled

- Penalty registers and discount registers

- Reconciliation logs showing who matched which payments

- Batch reversal and credit note history

This export saves weeks of preparation time during audits. Instead of pulling data from scattered spreadsheets, committees can hand auditors a complete, structured package.

Why reports are important for governance

Good reporting is not just about numbers. It is about accountability. When residents question charges, when auditors ask for evidence, or when regulators inspect compliance, reports are the society’s shield. Mygate ERP ensures that everything from a late payment penalty to an IRN failure is documented, searchable and exportable.

Why a runbook is needed

Even with the best system, invoicing can go wrong if the committee does not follow a routine. Meter readings might be missed, penalties may be misconfigured, or IRNs could fail because GST details are outdated. A runbook gives treasurers and admins a step-by-step approach that reduces the chance of error. Mygate ERP is built to support this discipline, but the committee must still apply it consistently.

Day-before checks

Before generating invoices, the committee should:

-

- Review house master data to confirm unit areas, BHK counts and GSTINs are correct

- Verify all meter readings have been entered or uploaded for utilities

- Confirm that penalty and arrear settings in templates reflect current policy

- Check that invoice sequences are aligned with GST character limits

- Run a test generation of one or two sample flats in draft mode to ensure calculations look right

Billing day workflow

On the day invoices are due to be raised:

-

- Generate draft

- Select the invoice template and generate the batch in publish later mode.

- Record the batch ID for reference.

- Verify the draft

- Download the Excel export and check totals, arrears and penalties flat by flat.

- Review a sample of PDF invoices to confirm layout and tax details.

- Use MIS and dues reports to confirm society-level balances.

- Correct errors

- If widespread, reverse the batch and regenerate.

- If limited to a few flats, correct their data and regenerate those invoices.

- Publish invoices

- Once verified, publish the batch.

- Confirm residents receive notifications and payment options are enabled.

- Monitor the IRN tracker to ensure all B2B invoices generate IRNs successfully.

Post-publish checks

After publishing, the committee should:

-

- Import bank statements within a few days to reconcile early payments

- Check the unmatched payments list and clear discrepancies

- Monitor the E-Invoices tab for any failed IRNs and resolve them

- Review penalties and discounts granted during the cycle to ensure they align with policy

End-of-month or end-of-year actions

At the end of each cycle, committees should:

-

- Run an aging report to identify long-pending dues

- Export the discount register for committee review

- Convert provisional penalties if the society follows bulk conversion

- Generate a consolidated report of invoices, penalties, advances and reconciliations

- Archive verification exports (Excel or PDF from the draft stage) as proof of due diligence

Best practices to follow consistently

-

- Always run a draft first, never publish without verification

- Keep HSN codes updated for every item and penalty slab

- Train at least two admins in the invoicing process so there is no dependency on one person

- Use credit notes for corrections instead of manual ledger edits

- Lock invoice sequence and template changes to treasurers or senior admins

- Store audit exports and verification reports in a shared committee folder for easy handover

Why discipline matters

Residents judge the committee’s professionalism by how smooth the billing process feels. When invoices are timely, accurate and transparent, trust builds. When errors lead to disputes and reversals, that trust erodes quickly. By following a structured runbook and making use of Mygate ERP’s draft, publish and reporting features, committees can maintain both financial discipline and resident confidence.