Hyderabad

Highlights

- A significant 83% of gated communities expressed a supportive stance on the installation of EV charging stations within their communities.

- Safety concerns emerged as the most cited reason for resistance, closely followed by the additional financial burden that such installations might impose.

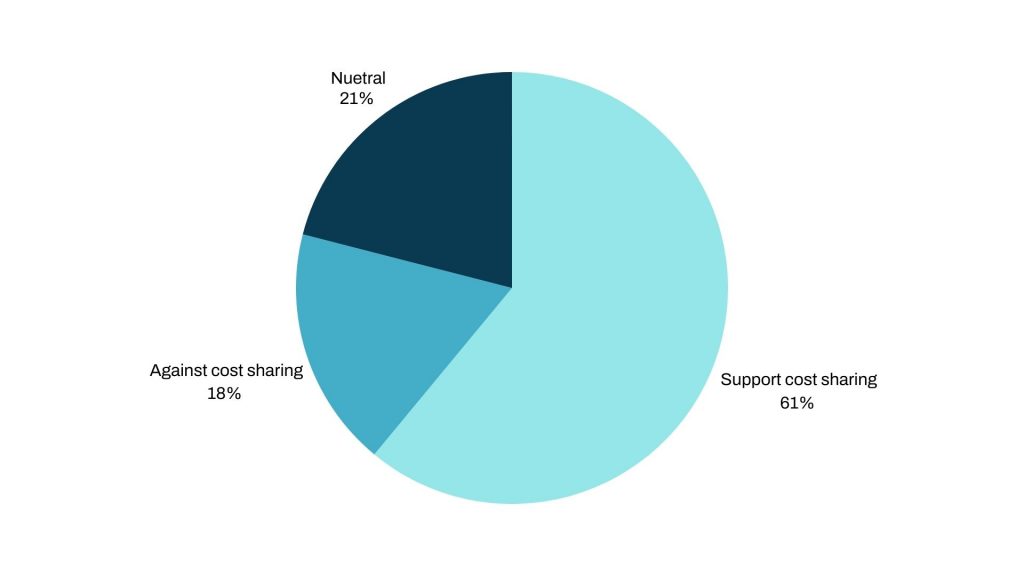

- 61% felt that all residents should share the cost of EV charging infrastructure, while 18% believed it should depend on the number of EV users.

- A majority of 81% of communites were against charging EV owners a higher maintenance fee, favoring equitable treatment across the community.

- The responses indicate a general openness to EV infrastructure but also highlight concerns that need to be addressed to ensure broad acceptance.

The need for easily accessible charging infrastructure has increased due to the rise in popularity of electric cars (EVs). Gated communities, with their controlled environments and dedicated parking spaces, offer an ideal setting for installing EV charging stations. However, implementing this kind of infrastructure may be difficult.

A recent survey by Mygate highlights the varying attitudes of communities towards this transition.Notably, 83% of resident welfare associations (RWAs) either supported or were neutral about installing EV charging stations within their communities while others voiced resistance due to concerns about infrastructure changes, safety, and space allocation. However Shweta, from Noida shared her enthusiasm, stating, “I’m very much interested in going green. EV charging installation is a step forward for our community, and it’s something I’ve been looking forward to.”

Resistance often comes from worries about how EV charging stations might shake up the existing setup and the safety risks they could bring. Plus, there’s the classic debate on whether we should all chip in for the costs or if EV owners should foot the bill—matter that requires careful consideration by everyone involved.

There’s also a split in opinion regarding cost distribution. Results say 61% of communities felt that all residents should share the cost of EV charging infrastructure, while 18% believed it should depend on the number of EV users. Anita from Mumbai expressed, “I think it’s only fair that everyone contributes since the infrastructure benefits the entire community, not just the EV owners.” However, her neighbor Sunil countered saying “It makes sense for EV users to bear the cost since they’re the ones directly benefiting from the charging stations.”

Mygate Locks allow you to monitor and control your door’s status from anywhere using your smartphone. Whether you’re at work, traveling, or just out for the evening, you can lock or unlock your door remotely, ensuring your home is always secure, even when you’re not there. With the Mygate Lock Pro you can go a step further and check the real-time door status, whether the door has been left closed or ajar.

Moreover, while integrating EV charging infrastructure in gated communities presents challenges, it also brings significant benefits. Embracing this change proactively can position communities as leaders in sustainability and enhance their appeal to future residents.

Highlights

- 51% of respondents acknowledge conflicts within their societies, with 14.4% reporting frequent conflicts and 34.6% experiencing them occasionally.

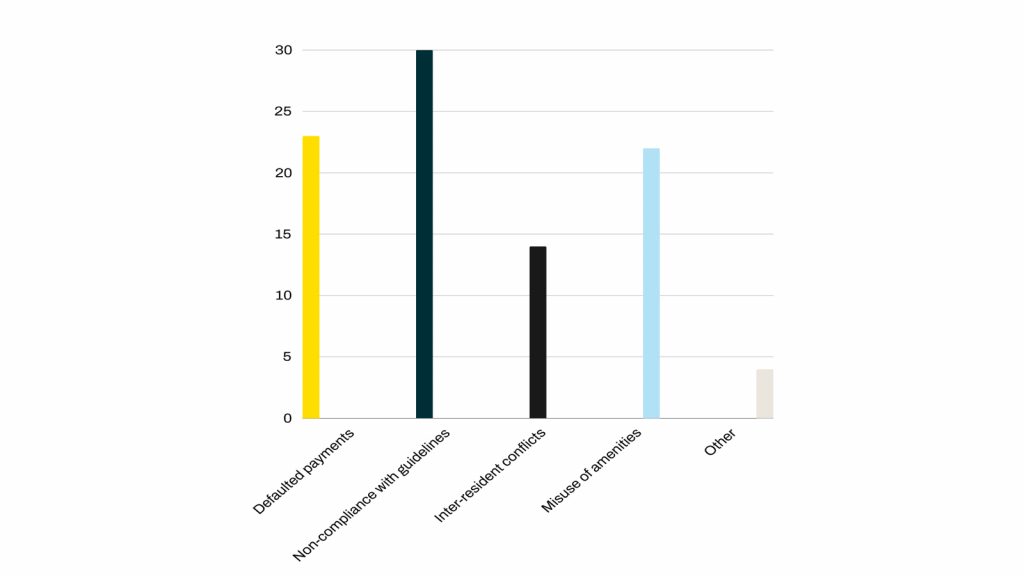

- Non-compliance with community guidelines (32.3%) and defaulted payments (24.7%) are the primary causes of conflicts.

- Among communities without owner-tenant conflicts, 76.9% of respondents attribute the absence of disputes to effective management and community engagement.

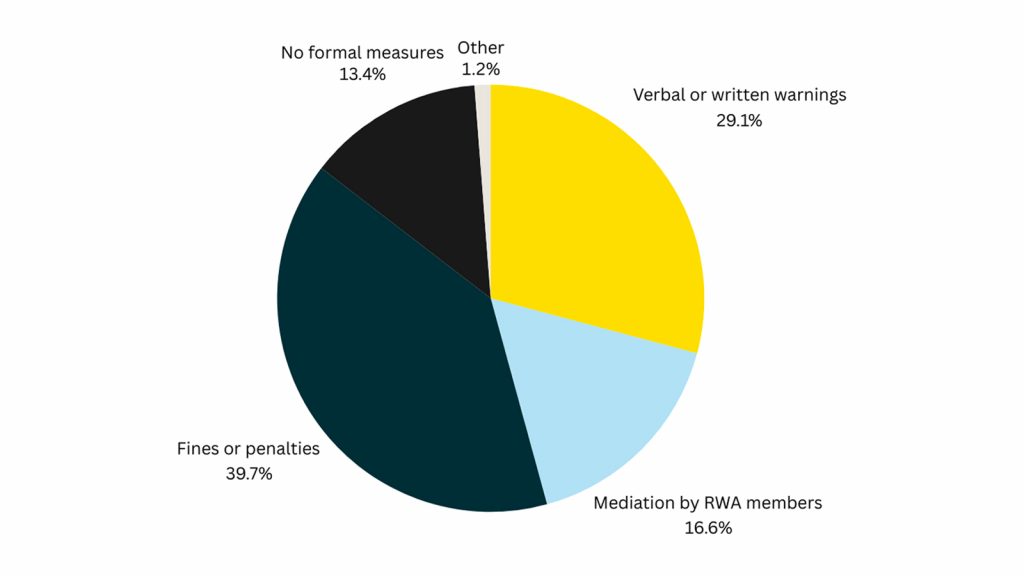

- Fines or penalties (39.7%) and verbal or written warnings (29.1%) are the most common measures used to combat issues.

- 13.4% of respondents have remarked that no formal measures have been implemented for conflict resolution.

- Over half (59.4%) of RWAs have separate guidelines for tenants, with 22.8% admitting that these guidelines aren’t strictly enforced.

- 52.9% of respondents state that tenants do not enjoy equal voting rights compared to homeowners, while only 38.2% affirm that tenants have equal voting rights.

Managing a residential community presents unique challenges, particularly in maintaining harmonious relationships between owners and tenants. A recent nationwide survey conducted among RWA members provides revealing insights into owner-tenant dynamics, conflict resolution, and community governance, uncovering the often-overlooked tensions that simmer beneath the surface.

“Conflicts with tenants are a real headache. They disrupt the peace and harmony we’ve worked so hard to maintain,” says Priya Sharma, an RWA member from Bengaluru. Her sentiment echoes across numerous communities, with the survey revealing that 51% of respondents acknowledge conflicts within their societies. While 14.4% report frequent conflicts, 34.6% experience them occasionally. The primary culprits? Non-compliance with community guidelines (32.3%) and defaulted payments (24.7%), followed by inter-resident disputes and the misuse of amenities.

“Sometimes it feels like we’re playing referee in a never-ending match,” laments Rajesh Nair, an RWA president from Mumbai. Yet, intriguingly, among communities without owner-tenant conflicts, 76.9% of respondents said the absence of disputes wasn’t due to a lack of tenants. This suggests that factors such as effective management and community engagement are pivotal in maintaining peace.

However many RWAs have turned to strict measures in place to combat the issues, fines or penalties (39.7%) and verbal or written warnings (29.1%) being the most common. Structured strategies such as these provide a path to manage disputes effectively. Among respondents, 13.4% have remarked that no formal measures have been implemented. “We often rely on ad-hoc solutions, which are neither fair nor effective,” admits Meera Joshi from Pune.

Regarding tenant guidelines, over half (59.4%) have separate guidelines in place, with 22.8% admitting that these aren’t strictly enforced. “Without stringent rules in place, misunderstandings are inevitable,” says Anil Verma, a resident from Chennai. Establishing clear guidelines could help reduce conflicts and foster community cohesion.

The survey also uncovers disparities in voting rights, with 52.9% of respondents stating tenants do not enjoy equal voting rights compared to homeowners. Only 38.2% affirm that tenants have equal voting rights, while 8.8% note variations depending on the poll.

The findings highlight the effectiveness of clearer guidelines, efficient conflict resolution, and equitable governance to foster harmonious and inclusive living environments. By addressing these areas, RWAs can enhance the overall living experience within their communities, ensuring peace and stability for both owners and tenants.

The treasurer of a Resident Welfare Association (RWA) holds a pivotal position, entrusted with the management of the community’s collective funds. This role demands meticulous attention to detail and a deep understanding of financial regulations. Unlike other RWA board members, the treasurer is responsible for handling substantial sums of money. This involves a wide range of tasks, from timely invoice generation and debt collection to budgeting and bank account management.

To make things simpler to manage, following a few ground rules usually helps.

In this blog, we are going to talk about those basic ground rules, and that is about the number of RWA bank accounts you should have for managing your Community funds.

Managing RWA Finances: Streamlining Bank Accounts

When taking charge of supervising the finances of a Resident Welfare Association (RWA) as a Treasurer, Board Member, or Community Manager, the first question you should ask is:

How many bank accounts does the Association hold?

Ideally, the answer should be no more than 1-3 per Association.

If your Association feels that multiple bank accounts are necessary, there should be a compelling reason for it. Managing numerous RWA bank accounts can be challenging and inefficient. Here are key considerations for maintaining multiple bank accounts:

- Structuring of Operating Fund and Reserve Fund

- Possible Diversification against Bank Defaults

Typically, you can manage with just two RWA bank accounts:

- Operating Account: This account handles the day-to-day operations and expenses of the homeowners association or RWA.

- Reserve Fund Account: This account is for the community’s savings, used for large future projects or unexpected major expenses (e.g., building painting, new play area construction, significant repairs due to natural calamities).

Some RWAs end up opening multiple bank accounts to manage various segments, such as different types of reserve fund requirements or different operating expenses. Additionally, some may open multiple accounts to take advantage of various benefits or offers from banks. However, creating too many segments can lead to complications in managing the accounts. It’s best to keep things simple and streamlined with just two accounts unless there are strong reasons for more.

Challenges of Multiple RWA Bank Accounts

Maintaining multiple bank accounts for an RWA can introduce several complexities:

- Increased Administrative Burden: Each account requires regular reconciliation with financial records, a time-consuming process even for inactive accounts.

- Operational Challenges: Whenever the RWA board changes, updating signatory details across multiple accounts can be cumbersome and error-prone. Overlooking a single account can freeze its funds.

- Potential for Misuse: Less frequently used accounts may receive less scrutiny, increasing the risk of financial irregularities.

So, the first day in office for a Treasurer should be to take stock of the Bank Accounts! Sunset redundant Bank Accounts, and ensure any new Bank Account opening follows a Due Diligence process – Passing a Board Resolution is just one of them.

Highlights

- A striking 77% of gated communities face tensions between pet owners and non-pet owners.

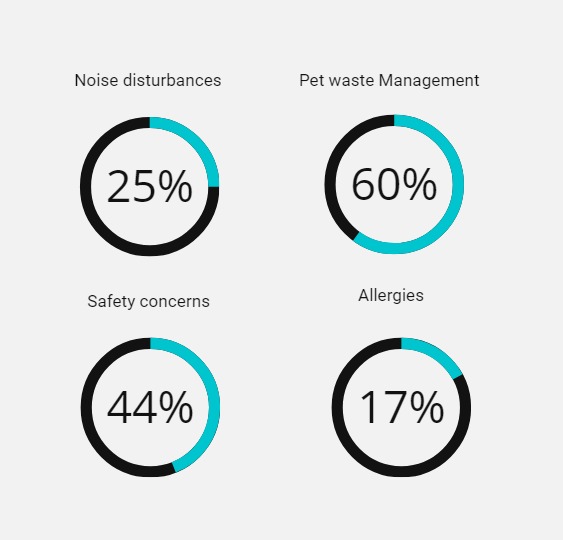

- These disputes often stem from noise complaints (25%), pet waste issues (60%), safety fears (44%), and allergies (17%).

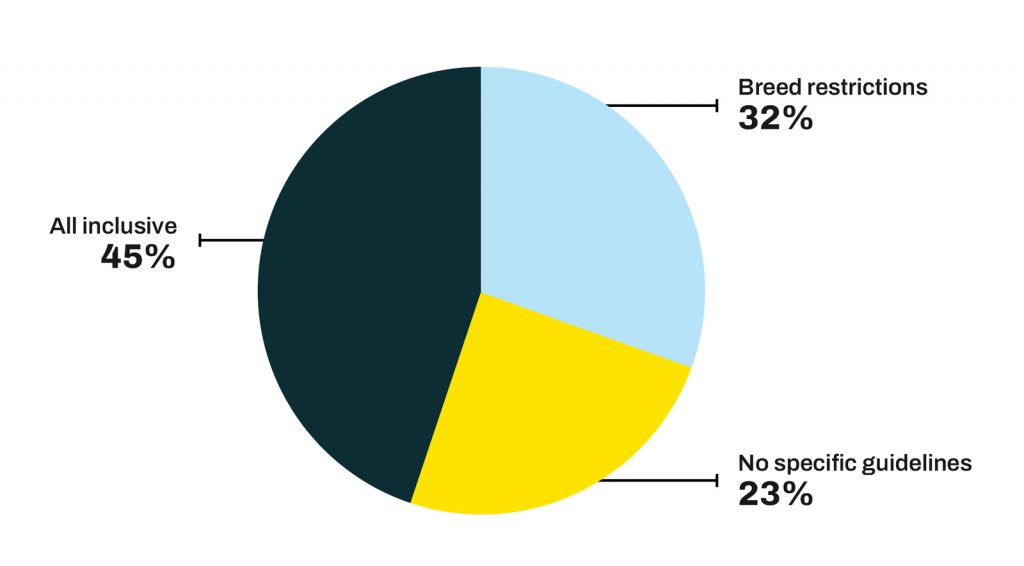

- Only 10% of communities enforce strict breed restrictions, while a notable 45% aim for inclusivity while ensuring everyone’s comfort and safety.

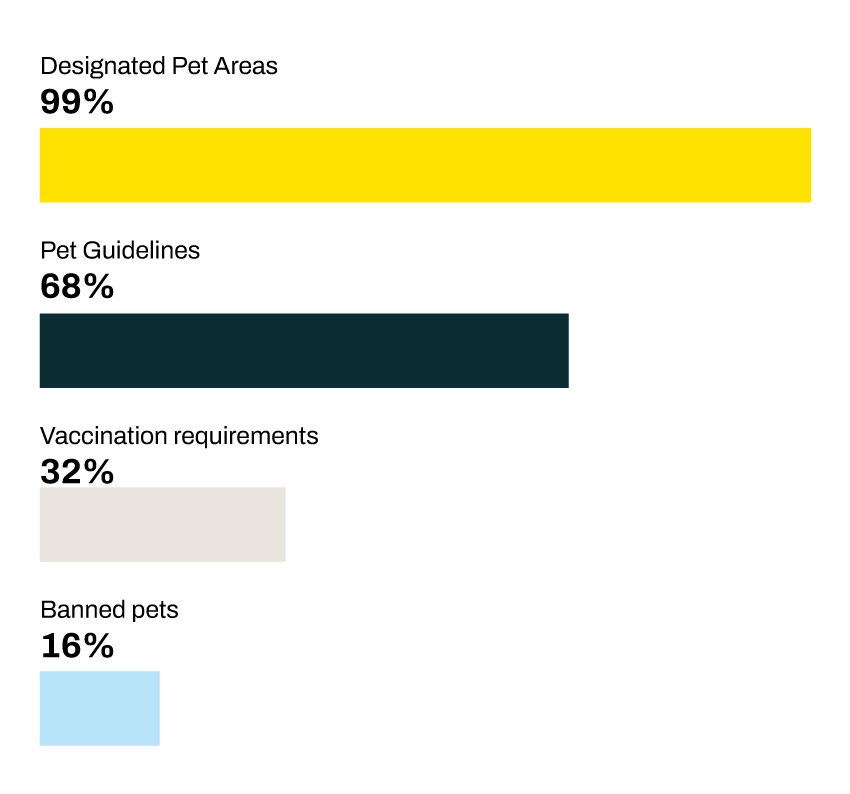

- Nearly all RWAs (99%) maintain designated pet areas meticulously to uphold community standards.

- A significant 68% establish clear guidelines for pet behaviour and owner responsibilities to foster mutual respect.

- 32% of communities create specific zones for pet activities to minimize conflicts, promoting peaceful coexistence.

Over the past year, pet management in gated communities has sparked nationwide debates and protests, from allegations of discrimination against pet owners to serious pet accidents. To understand this issue, we conducted a survey in Mygate communities, revealing significant tensions and diverse perspectives on pet ownership & management.

Community pets often strays, live freely within communities. They sleep, eat, and interact as they please, leading to mixed reactions from residents.

A substantial 80% of Resident Welfare Associations (RWAs) voiced complaints, seeing these pets as sources of conflict between pet owners and non-pet owners. Mini from Mumbai highlighted a common sentiment: “It’s unheard of in other countries—stray dogs in gated communities. Dogs should have owners.”

In contrast, indifference toward community pets is prevalent in places like Chennai, although resident-owned pets spark high emotions and divisions. Our survey revealed that 77% of gated communities experience conflicts between pet owners and non-pet owners. Common issues include noise disturbances (25%), pet waste management (60%), safety concerns (44%), and allergies (17%).

Residents like Shahdab from Sarjapura, Bengaluru, face challenges due to a lack of designated pet areas, forcing them to walk pets outside the premises. Souvik Das from Akshayanagar, Bengaluru, shared that despite the community’s pet-neutral stance, some residents object to pets in common areas, leading to frequent disputes.

The type of pets and their breeds also influence conflict frequency. Communities with certain dog breeds often face more disputes, prompting RWAs to implement specific policies. About 10% of communities enforce breed restrictions, while 45% prioritize inclusivity while ensuring safety and comfort. RWAs adopt various strategies, such as maintaining designated pet areas (99%), setting clear pet behaviour guidelines (68%), and enforcing vaccination & health check requirements (32%).

A Noida RWA member emphasized the recurring issue of pet-related accidents. In contrast, a Bengaluru pet committee member highlighted the community’s focus on education and responsible pet ownership over strict breed restrictions, promoting a harmonious environment.

Strategic initiatives by RWAs have shown positive outcomes. Residents appreciate the efforts such as dedicated pet zones to balance the needs of pet owners and non-pet owners, fostering inclusivity and support.

Examples of successful policies include pet registration on Mygate and the vaccination program, which reduced health concerns and enhanced community cohesion.

Effective pet management in gated communities requires a holistic approach, blending empirical data with resident experiences. By understanding conflict’s root causes, implementing inclusive policies, and fostering respect and responsibility, RWAs can create harmonious environments for pets and people. “It’s about creating a community where everyone feels valued, regardless of their pet companions,” noted a Delhi RWA member.

This exploration is crucial amid rising polarized social media debates over pets. Understanding the varied and often positive interactions between pets and humans can inform the creation of pet-friendly solutions that enhance community living for all.

Co-operative housing societies follow the model bye-laws, which are comprehensive and prescribe a number of rules and procedures for elections. In this article, we will simplify and decode how election of managing committee of housing society works. We will cover the important facets that truly matter for the election procedure for a co-operative society.

Housing society election due date

Within the first three months of registration of the society, the Chief Promoter is required to call the First General Body Meeting of the society, Election being one of the topmost priorities of the meeting along with the constitution of the Provisional Committee until regular elections are held under bye-laws of the Society. Regular elections are supposed to be held once every five years as per the Bye-Laws.

Voting rights of members of housing society

All members: According to a recent amendment, any eligible or associate member is to be granted the right to vote as soon as he/she is admitted as a member of the society.

On house, one vote: Each unit of a housing society has a vote. For example, if you own multiple flats/houses in a society, each of them is liable to get a vote. Even those who default payments are allowed to vote.

How many members are there in a society committee?

| Number of members in a Society | General | Reserved (Women SC/ST OBC VJ/NT/SBC) | Total | Quorum for Meeting (simple majority of the existing Committee Members) |

|---|---|---|---|---|

| Upto 100 | 6 | 5 | 11 | 6 |

| 101 to 200 | 8 | 5 | 13 | 7 |

| 201 to 300 | 10 | 5 | 19 | 10 |

| 301 to 500 | 12 | 5 | 17 | 9 |

| 501 and above | 14 | 5 | 19 | 10 |

Who is not eligible for candidature?who cannot become committee member of housing society?

According to the Model Bye-Laws, a critical reason for a member to not be able to contest an election is If he defaults the payment of dues to the society, within three months from the date of service of notice in writing.

An Associate Member (a person with joint ownership whose name does not stand first in the Share Certificate) for whom the Original Member has not issued a No-Objection Certificate cannot contest the Election.

Proposers (someone who nominates a candidate) and seconders (someone who supports the nomination) have no such restrictions as they are allowed to nominate and support any number of candidatures irrespective of defaulted payments or arrears.

How many members are required in a managing committee?

Under Bye-Law 113, the strength of the Managing Committee could be made up of 11, 13, 15, 17 or 19 members, with respect to the number of total members in the society. The break-up is as follows:

Forming a managing committee

Model Bye-Laws from 114 to 116 have put forth certain laws that help you in forming a strong and reliable Managing Committee.

Members of the Committee are to be elected every five years (before the expiry of the five-year term). An E-2 form to be submitted to the to the District Co-operative Election Officer or Taluka or Ward Co-operative Election Officer six months prior to the expiry of the Committee period of the society in case if the society has over 200 members. If they do not notify the State Election Authority and continue to hold office, it is a violation of the law resulting in action from the Registrar.

In order to oversee the objectives, special requirements or functions of the Society, two Expert Directors and/or two Functional Directors may be co-opted. But they will have no right to vote and do not count as members of the Managing Committee.

No office bearer is allowed to have any financial, transactional or vested interests with regards to the society, unless the financial transactions involve giving residential accommodation to the paid member of the society.

Societies with less than 200 members conducting independent elections are liable for a Rs 25,000 fine if they fail to produce accounts, documents, or paperwork to the government or the members of the society.

Who cannot become committee member of housing society?

Members with questionable moral behaviour, defaulted payments within three months of written notice, Associate Member without NOC from original member are not eligible. Anyone who sublets or rents their house without notifying the society in advance is also not eligible.

Anyone who fails to furnish valid bookkeeping/expenditure records with respect to the funds provided by the society is not eligible. Anyone who neglects their assigned duties and is deemed to be in breach of trust is not eligible to be part of the committee.

Over and above that, if a member has failed to attend any three consecutive monthly meetings of the Committee, without leave of absence, he is disqualified from the Committee.

Retired members who have not been disqualified are eligible for election.

Co-operative society election rules and process

The housing society election rules requires one to declare the initial procedures to the voters by the Managing Committee ( or the Provisional Managing Committee in case if the first Election is to be conducted) at least three months prior to the Election date.

A Returning Officer should be appointed to carry out the Voting Procedures and ensure adherence of the rules. A Returning Officer should be someone who is not contesting the Election in any capacity. Nor should he be proposing or seconding a candidate. In other words, he should be an absolutely unbiased and trusted individual. Usually, someone takes up this position voluntarily. Otherwise, members jointly entrust the responsibilities on a member they deem fit for the duties. In many cases, a financial compensation is made to the Returning Officer for his professional services.

The Conduct of Election should involve the following steps that make the entire procedure methodical and hassle-free. Each process should be published on the Notice Board of the society within ten days of displaying the final list of the voters.

| Steps | Requirement |

|---|---|

| Date of declaration of election programme | Date to be announced at the time of declaration of programme. |

| Last date for making nominations | 5 days from the date of declaration of election programme. |

| The date of publication of list of nominations received | As and when received till the last date fixed for making nominations. |

| Date of scrutiny of nominations. | Next day of the last date for making nominations. |

| Date of publication of list of valid nominations after scrutiny. | Next day after the date of completion of scrutiny. |

| Date by which candidature may be withdrawn. | Within 15 days from the date of publication of list of valid nominations after scrutiny |

| Date and time during which and the place/ places at which the poll shall be taken if necessary. | Not earlier than 7 days but not later than 15 days from the date of publication of the final list of contesting candidate (time and place to be fixed by the Returning Officer). |

| Date, time and place for counting of votes. | Not later than the third day from the date of which the poll shall be taken (Time and place to be fixed by the Returning Officer). |

| Date of declaration of results of voting. | Immediately after the counting of votes. |

If the paid up share capital of the said society is more than Rs. 10, 000, the voting is conducted by secret ballot.

At the time of the voting, each member is shown an empty ballot box before they cast their vote. The Ballot Paper usually has the seal of the society and the counterfoil the initials of the Returning Officer. The Ballot Box is sealed in front of the voters and all the documents/votes relevant to the Election are stored safely by the Secretary who is required to preserve them for three months and then destroy them afterwards. This is done in case of disputes.

After the results, the current committee hands over the charge to the newly elected committee.

In summary, timely execution of required procedures is quite essential to carry out an Election successfully. At each step of the way, the members need clarity and transparency from the elected members . At the same time, members need to be proactively involved in the election procedures as it is commonly observed in many housing societies that the same individuals are selected as office bearers in every term. This may lead to lethargy, inefficiency, or malfeasance in many cases.

Important points to note regarding housing society elections

Equal voting right: In general, each member of the housing society who owns a property has equal voting rights. In general, a member with a larger flat, say 3BHK, does not have a higher voting weightage than someone with a smaller flat, say 2BHK. A person who owns two flats in the society, on the other hand, gets two votes. Votes are usually cast based on the number of units rather than the number of members. In exceptional societies formed as limited liability companies rather than cooperatives, voting rights vary depending on the size of the unit. The Right2Vote eVoting platform allows you to create all types of elections, including those with weightage based on the number of units and weightage based on the size of the flat.

Voting rights of owners: All members of the housing society who own property have the right to vote. No member should be denied the right to vote. In most cases, the first owner has the right to vote, but co-owners may be allowed to vote as well.

Denial of voting rights: A bylaw may state that members who have not paid their society dues in full may be denied voting rights.

Tenant voting rights: In general, tenants do not have voting rights. Each flat’s voting rights are limited to the flat’s owner.

Voting window: To vote, a voter must be given a reasonable voting window. Keeping a very short voting window is restrictive and may lead to members complaining that their right to vote was denied. We recommend a minimum voting window of 8 hours if all of your voters are in India, and a minimum of 24 hours if your members are located outside of India to account for different time zones. In general, many societies keep a voting window of less than 2 hours, which can lead to legal issues.

Reasonable notice of election date and voting window: All voters should be given advance notice of the elections. In general, a minimum of 14 days advance notice is required. However, depending on the bye law, it can vary from society to society.

Intimation of election date and process: A society must notify its members in advance of its intention to hold elections and solicit nominations for various positions. This is usually done at least 21 days before the election date. The rules and procedures for nomination and election must also be distributed by the society.

Right to stand in elections: All owners/members have the same right to vote in elections. No owner can be denied the right to vote unless:

- the owner’s title to the property is in dispute.

- The owner has not paid all of the society’s dues.

Election method: The Acts or model bye laws have generally been silent on the election method, so both paper-based voting and online voting can be used. A show of hands is generally not recommended, especially when a’secret ballot’ is required. More information on this topic can be found on this blog.

Secret ballot: Most State Cooperative Acts and model bylaws state that members should be elected by secret ballot. Nobody, not even the election officer, should be able to tell which members voted for which candidates using a secret ballot. This is to ensure secrecy of member’s vote so that member can vote with his free will and there is no chance of coercion.

Proxy voting: The majority of Acts and model bylaws state that “members should vote in person.” This means that proxy voting is not permitted. It should not be confused with the requirement of voter physical presence. It simply means that a voter cannot delegate his or her voting rights and responsibilities to someone else. Proxy voting clauses differ from society to society; please carefully review your bylaws for the same.

Postal voting: Many Acts and bye-laws expressly provide for postal voting, in which members can vote by mail. However, due to election deadlines, postal voting is generally not feasible, and online voting is a preferred option for voters who live elsewhere or are traveling.

Election of Committee Members: Rules differ in model byelaws relating to election of committee members. In a few states, such as West Bengal, members vote to elect committee members, and the committee members decide who will hold the titles of President, Treasurer, Secretary, and so on. Members in other states, such as Karnataka, vote directly to appoint specific candidates to positions such as President, Treasurer, Secretary, and so on. Members in other states, such as Karnataka, vote directly to appoint specific candidates to positions such as President, Treasurer, Secretary, and so on. A few members are also elected to the committee. Right2Vote’s eVoting platform includes ‘Team Election – Exact’ and ‘Team Election – Upto’ features to assist societies in electing a team of committee members from the same list of candidates. Check your bylaws to see if voters can choose an exact number of candidates or if they can choose fewer than the number of positions. Both customizations are available on the Right2Vote platform. This feature is not available on the majority of other platforms.

Central Goods and Services Tax is an indirect tax to be paid by end-users for the consumption of goods and services. It was implemented in 2017, and it applies not just to individuals and corporations, but to housing societies as well, with exceptions, of course.

To understand in-depth the correct eligibility criteria for a housing society’s liability towards GST, here’s a comprehensive guide that covers all essential information and facts you need to know about co-operative society compliance with GST rules.

What is GST & inclusion provision under the Act

| Act | Inclusions/Definitions |

|---|---|

| CGST Act 2017 Section 7 | “Supply” includes all forms of supply of goods or services or both, such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business. |

| CGST Act 2017 Section 7 And Section 2 (17 e) | States “business” as “Provision by a club, association, society, or any such body (for a subscription or any other consideration) of the facilities or benefits to its members. |

GST Act applicability to housing societies

1. As per Section 2(84) “Person” includes

a co-operative society registered under any law relating to co-operative societies or a Society as defined under the Societies Registration Act, 1860. A cooperative housing society is to be considered as a ‘person’ under the definition of ‘supply’.

2. As per Sec 2(31) “Consideration”

in relation to the supply of goods or services or both includes (a) any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government.

Housing society registration under GST

As per Section 22, if the turnover of the housing society is over Rs 20 lakh and/or it levies more than Rs 20 lakh in aggregate annual maintenance charges in a financial year, it needs to take registration under GST laws and obtain a registration number, but the payment of GST depends on other parameters (covered below).

However, there are exceptions for Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand, where the threshold limit for registration liability is Rs 10 lakh.

Criteria for applicable GST payment for society maintenance

If the society’s monthly maintenance bill is more than Rs 7500 per house, 18% GST is applicable on the entire amount.

If a person owns more than one residence in a society, then a ‘separate’ ceiling of Rs 7500 is considered as the second unit also gets an individual exemption of Rs 7500.

However, there is an exemption if the annual aggregate turnover of the housing society is not over Rs 20 lakh.

Thus, for GST to apply, two criteria must be met.

| Annual turnover of a housing society | Monthly maintenance charge | GST |

|---|---|---|

| ₹20 Lakh or less | ₹7500 or less | Exempt |

| ₹20 Lakh or less | More than ₹7500 | Exempt |

| More than ₹20 Lakh | ₹7500 or less | Exempt |

| More than ₹20 Lakh | More than ₹7500 | Applicable |

Furthermore, GST doesn’t apply to the difference amount alone. For example, if the monthly maintenance bill is Rs 9000, GST will apply to the entire amount, not just to Rs 1500.

Property Tax, Water Tax, Municipal Tax, Non-Agricultural Land Tax paid to the state are exempt from GST.

Sinking Fund, Maintenance and Repair Funds, Car Parking funds, Non-Occupancy Funds, interest from late payments, are not exempt from GST since they are considered charges collected by the society for the supply of services to members.

Let’s understand this in detail for clarity.

Inclusions and exclusions for the societies that fall above the limit of Rs 7500

1. Sinking fund

It is considered a type of service provided by the housing society to its residents hence included.

2. Repairs & maintenance fund

This falls in the category of residents paying for repairs, common services, audits, maintenance dues, etc., thus it’s to be considered as inclusion as it falls under taxability.

3. Non-occupancy charges

These are not considered a part of the Property Tax for common premises, hence included.

4. Parking charges

The same logic applies for parking charges since it’s an individual collection for a specific service.

5. Water charges

If the water charges are collected on behalf of the members by the society for individual use (e.g. water tankers or government source), then they don’t fall under taxation under GST limit as tax may already be applied on it as per the law. If the water charges are for common use,l (e.g. generating electricity to give drinking/potable water facilities as a service), then they’re included under the Rs 7500 limit.

6. Property tax

Property tax on common areas is to be considered as an inclusion in the limit as well. However, if the society is only an intermediary, collecting individual residents’ property tax and handing it over to the government, then it’s not considered under the limit. Property Tax on any other places, like stores and parking spaces (if applicable) should be subject to respective law but not included in GST calculations.

7. Share transfer fees

At the time of property sale share transfer fees are charged which are taxable, which is why they are not included in GST.

8. Common services

Services like the clubhouse, gym, pool are considered taxable, hence must be utilised under GST calculations. If a society uses common spaces like clubhouse, garden, terrace or any other part of the premises for use of members and outsiders on rent, for hire, it’s liable for tax, hence must be covered under the calculation slab.

9. Income received as interest on defaulters

It is considered an individual charge and not used for common uses, thus it’s excluded from taxation consideration.

10. Income received from renting space

Income received from renting space for mobile towers is derived from business, thus it’s to be included in the calculation.

Input tax credit for society

ITC is the tax reduction that you can claim since you’ve already paid on the goods and services. For example, if you’re a housing society who has paid for pipes and construction materials for repair and maintenance of your premises, or have hired the services of an Auditor for your annual accounts, you can claim the credit upon it.

Housing Societies will avail the benefits of ITC which means that if they pay taxes on repair and renovation, capital goods (generators, lawn furniture, water pumps, etc.) and other goods (taps, pipes, hardware, construction materials), they will receive a tax deduction but for them to avail this benefit, the reverse charge mechanism will apply on all goods and services received by suppliers; the set-off can be claimed against the tax liability for maintenance funds.

However, this benefit is available if the amount charged for these supplies is over Rs 7500 per member.

A housing society can impart the benefits of Input Tax Credit by lowering the maintenance charges for members, the amount of which can be determined after proper cost analysis and comparison of output/input tax amounts against overall expenses and income.

What are the requirements for claiming ITC for housing society?

- Society should have the tax invoice

- Goods/services procured should be received, and if they’re being received in installments, the last installment should be received before claiming ITC.

- Tax Returns should have been filed by the society

- The supplier of goods/services has paid the tax being charged to the government.

- ITC is not allowed if the depreciation has already been claimed on the tax component of capital goods/services.

Periodic filing & compliance rules for housing society

A housing society has to file 37 returns, three returns per month, which include:

- Billing Side – 10th of the following month

- Expense Side – 15th of the following month

- Consolidated Return – 20th of the following month

- As well as: One Annual Return GSTR 9 by the end of 31st December next year (for the year 2019-2020 by 31st December 2020)

If a housing society deducts TDS, then they have to file GSTR7 by the 10th of the following month. Housing Societies do not fall under the Composition Scheme.

MC/RWA are expected to maintain proper records of all Supply and Expense reports for 72 months for auditing purposes.

Different GST forms & their importance

- GST 1 – to be filled by all regular taxpayers who are registered under GST, including casual taxable persons (with debit/credit notes, invoices of outward supply).

- GST 2A(&B) are view/read-only available and relevant for the recipient or buyer of goods and services, and can be referred to when any invoice is missing, the buyer can communicate with the seller to upload it in their GSTR-1. No action can be taken on GSTR 2. 2B contains constant ITC data for back referral.

- GST 3B (3 not in use currently)- This is also to be filled by all normal taxpayers, including societies, to provide details of supplies made, ITC claims details, tax liabilities, and payments.

Housing societies should ensure that sales/supplies and ITC details are reconciled with GSTR 1 and GSTR 2B every tax season before filing GSTR 3 B.

Frequently asked questions

It’s Goods and Services Tax, which is levied on the supply of goods and services and is a value-added tax levied on most goods and services sold for domestic and commercial consumption.

No.

Yes. GST exemption and application apply to property used for commercial purposes.

Yes. If the vendor’s services fall under GST rules, the society has to pay as per the percentage applied. E.g., GST payable for contractor services.

In this case, GST applies only to the second apartment for which the maintenance is Rs 8000.

How does this affect maintenance bill/other bill formats?

The society has to add GST to the monthly, quarterly, and yearly invoices and mention the GSTIN No on all invoices where applicable.

What forms are to be used for monthly filing?

Monthly GST forms are GSTR 1, GSTR 2A,and GSTR 3.

On what repair and maintenance services is Input Tax Credit allowed?

On services such as lift AMC, Housekeeping, Security, Fire AMC, Contracting Staff, Accounting and Auditing Services, etc.

What should be excluded while calculating the limit of Rs 7500?

Property tax, electricity charges collected from individual flat owners and other statutory levies are excluded.

What should be included while calculating the limit of Rs 7500?

Water/electricity charges for common areas and common services like clubhouse, swimming pool, along with parking charges, common property tax, payments for repair and maintenance, security, admin, accounting, Non Occupancy charges.

Are share transfer fees/ interest on late payment included in the limit of Rs 7500?

No. Share Transfer Fees are taxable but not included in the Rs 7500 limit as no third party is involved. Similarly, interest on default is an individual charge, so it’s taxable, but not covered under the limit of Rs 7500.

Does GST apply to housing societies?

Ever since the changes in Budget 2021 were introduced, all types of cooperative housing societies are included under GST applicability as they provide services to the members. However, exemptions apply.

It’s 18% (State GST is 9% and Central GST is 9%).

What are the documents needed?

a) In general, invoices issued by the supplier.

b) An invoice such as a Bill of Supply if the amount is less than Rs 200 or if reverse charges mechanism applies.

c) Bill of Entry or similar documents issued by the Customs Department (if applicable)

d) Bill of Supply issued by the supplier

e) Other documents required in the Form

Is GST applicable to maintenance charges paid by residents?

Maintenance charges up to an amount of Rs. 7500 per month, per member, are exempt from GST. Earlier, the exemption was available on a monthly maintenance charge of up to Rs. 5000 per member. The limit was increased to Rs. 7500 with effect from 25th January 2018.

How does the GST exemption work if a person owns two or more flats in a housing society?

In such case, GST exemption of Rs. 7500 per month, per apartment, shall be applied separately for each apartment owned by him.

For example, if a person owns two residential apartments in a society and pays Rs. 15000 per month as a maintenance charge (calculated at Rs. 7500 per month, per apartment), the exemption from GST shall be available to each apartment.

How is GST payable in societies where maintenance charges exceed Rs. 7500 per month, per member?

In case, for society, the maintenance charges exceed Rs. 7500 per month, per member, the entire amount is taxable.

Let’s understand this with an example. If the monthly maintenance charges for a housing society are Rs. 9000 per member, the GST @18% shall be payable on the entire amount of Rs. 9000 and not on Rs. 1500.

* Refer to the latest GST circular issued by the Government of India, Ministry of Finance Department of Revenue (Tax Research Unit), New Delhi.

How does the GST calculation work (with example)?

| Total amount received | Water charges | Sinking fund | Taxable |

| 8000 | 500 | 500 | 7500 |

| 4000 | 500 | 500 | 0 |

What is the procedure to claim ITC and how much can be claimed?

Taxpayers should enter the ITC amount in their monthly, quarterly, yearly GST forms (Form GSTR-1,2,3) and enter details like amounts eligible and ineligible for ITC and reversal, etc. as mentioned in the form. The recipients can claim provisional input tax credit in GSTR-3B to the extent of 5% instead of earlier 10% of the total ITC available in GSTR-2B for the month.

Where can society view the seller’s uploaded invoices?

Invoices uploaded by the seller in GSTR-1 can be viewed by the purchaser in his GSTR-2B form.