Bengaluru

Highlights

- A striking 77% of gated communities face tensions between pet owners and non-pet owners.

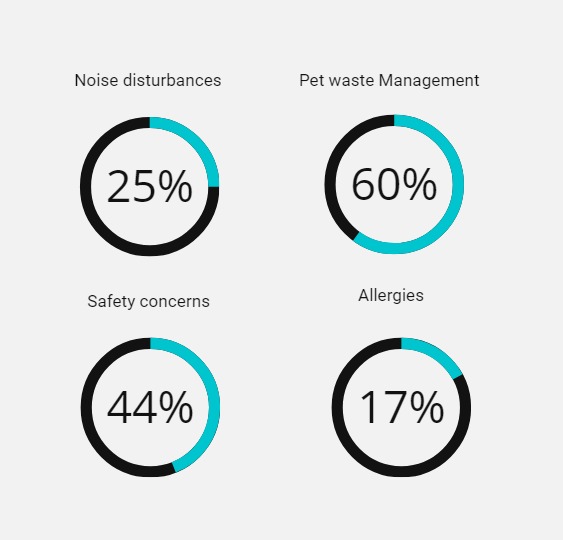

- These disputes often stem from noise complaints (25%), pet waste issues (60%), safety fears (44%), and allergies (17%).

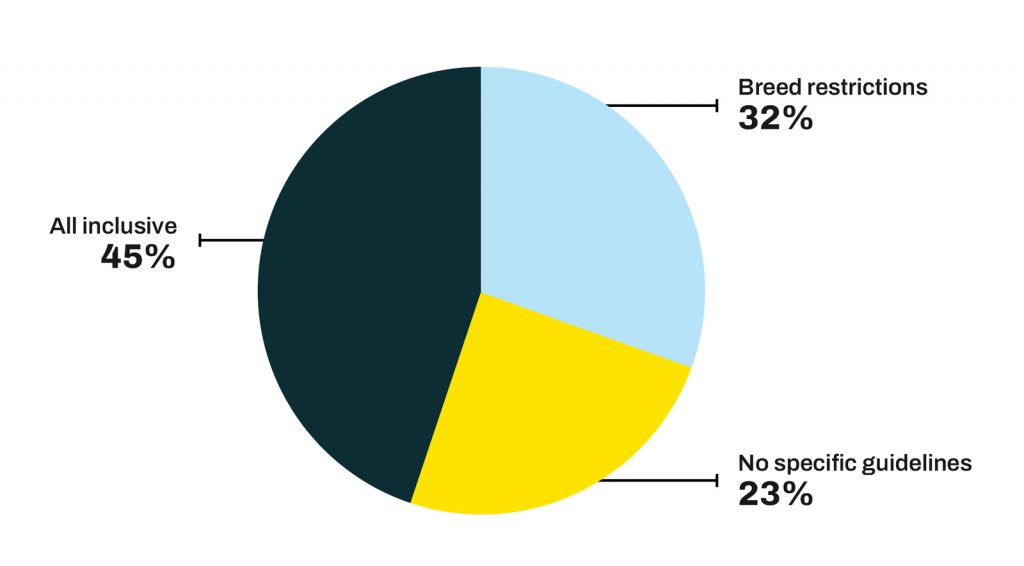

- Only 10% of communities enforce strict breed restrictions, while a notable 45% aim for inclusivity while ensuring everyone’s comfort and safety.

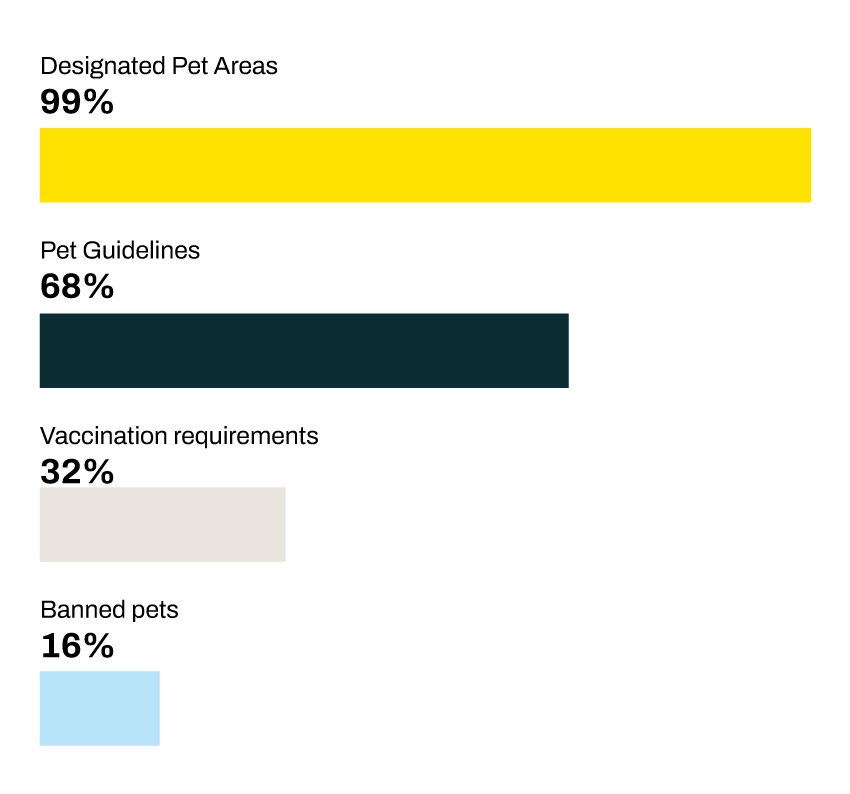

- Nearly all RWAs (99%) maintain designated pet areas meticulously to uphold community standards.

- A significant 68% establish clear guidelines for pet behaviour and owner responsibilities to foster mutual respect.

- 32% of communities create specific zones for pet activities to minimize conflicts, promoting peaceful coexistence.

Over the past year, pet management in gated communities has sparked nationwide debates and protests, from allegations of discrimination against pet owners to serious pet accidents. To understand this issue, we conducted a survey in Mygate communities, revealing significant tensions and diverse perspectives on pet ownership & management.

Community pets often strays, live freely within communities. They sleep, eat, and interact as they please, leading to mixed reactions from residents.

A substantial 80% of Resident Welfare Associations (RWAs) voiced complaints, seeing these pets as sources of conflict between pet owners and non-pet owners. Mini from Mumbai highlighted a common sentiment: “It’s unheard of in other countries—stray dogs in gated communities. Dogs should have owners.”

In contrast, indifference toward community pets is prevalent in places like Chennai, although resident-owned pets spark high emotions and divisions. Our survey revealed that 77% of gated communities experience conflicts between pet owners and non-pet owners. Common issues include noise disturbances (25%), pet waste management (60%), safety concerns (44%), and allergies (17%).

Residents like Shahdab from Sarjapura, Bengaluru, face challenges due to a lack of designated pet areas, forcing them to walk pets outside the premises. Souvik Das from Akshayanagar, Bengaluru, shared that despite the community’s pet-neutral stance, some residents object to pets in common areas, leading to frequent disputes.

The type of pets and their breeds also influence conflict frequency. Communities with certain dog breeds often face more disputes, prompting RWAs to implement specific policies. About 10% of communities enforce breed restrictions, while 45% prioritize inclusivity while ensuring safety and comfort. RWAs adopt various strategies, such as maintaining designated pet areas (99%), setting clear pet behaviour guidelines (68%), and enforcing vaccination & health check requirements (32%).

A Noida RWA member emphasized the recurring issue of pet-related accidents. In contrast, a Bengaluru pet committee member highlighted the community’s focus on education and responsible pet ownership over strict breed restrictions, promoting a harmonious environment.

Strategic initiatives by RWAs have shown positive outcomes. Residents appreciate the efforts such as dedicated pet zones to balance the needs of pet owners and non-pet owners, fostering inclusivity and support.

Examples of successful policies include pet registration on Mygate and the vaccination program, which reduced health concerns and enhanced community cohesion.

Effective pet management in gated communities requires a holistic approach, blending empirical data with resident experiences. By understanding conflict’s root causes, implementing inclusive policies, and fostering respect and responsibility, RWAs can create harmonious environments for pets and people. “It’s about creating a community where everyone feels valued, regardless of their pet companions,” noted a Delhi RWA member.

This exploration is crucial amid rising polarized social media debates over pets. Understanding the varied and often positive interactions between pets and humans can inform the creation of pet-friendly solutions that enhance community living for all.

Co-operative housing societies follow the model bye-laws, which are comprehensive and prescribe a number of rules and procedures for elections. In this article, we will simplify and decode how election of managing committee of housing society works. We will cover the important facets that truly matter for the election procedure for a co-operative society.

Housing society election due date

Within the first three months of registration of the society, the Chief Promoter is required to call the First General Body Meeting of the society, Election being one of the topmost priorities of the meeting along with the constitution of the Provisional Committee until regular elections are held under bye-laws of the Society. Regular elections are supposed to be held once every five years as per the Bye-Laws.

Voting rights of members of housing society

All members: According to a recent amendment, any eligible or associate member is to be granted the right to vote as soon as he/she is admitted as a member of the society.

On house, one vote: Each unit of a housing society has a vote. For example, if you own multiple flats/houses in a society, each of them is liable to get a vote. Even those who default payments are allowed to vote.

How many members are there in a society committee?

| Number of members in a Society | General | Reserved (Women SC/ST OBC VJ/NT/SBC) | Total | Quorum for Meeting (simple majority of the existing Committee Members) |

|---|---|---|---|---|

| Upto 100 | 6 | 5 | 11 | 6 |

| 101 to 200 | 8 | 5 | 13 | 7 |

| 201 to 300 | 10 | 5 | 19 | 10 |

| 301 to 500 | 12 | 5 | 17 | 9 |

| 501 and above | 14 | 5 | 19 | 10 |

Who is not eligible for candidature?who cannot become committee member of housing society?

According to the Model Bye-Laws, a critical reason for a member to not be able to contest an election is If he defaults the payment of dues to the society, within three months from the date of service of notice in writing.

An Associate Member (a person with joint ownership whose name does not stand first in the Share Certificate) for whom the Original Member has not issued a No-Objection Certificate cannot contest the Election.

Proposers (someone who nominates a candidate) and seconders (someone who supports the nomination) have no such restrictions as they are allowed to nominate and support any number of candidatures irrespective of defaulted payments or arrears.

How many members are required in a managing committee?

Under Bye-Law 113, the strength of the Managing Committee could be made up of 11, 13, 15, 17 or 19 members, with respect to the number of total members in the society. The break-up is as follows:

Forming a managing committee

Model Bye-Laws from 114 to 116 have put forth certain laws that help you in forming a strong and reliable Managing Committee.

Members of the Committee are to be elected every five years (before the expiry of the five-year term). An E-2 form to be submitted to the to the District Co-operative Election Officer or Taluka or Ward Co-operative Election Officer six months prior to the expiry of the Committee period of the society in case if the society has over 200 members. If they do not notify the State Election Authority and continue to hold office, it is a violation of the law resulting in action from the Registrar.

In order to oversee the objectives, special requirements or functions of the Society, two Expert Directors and/or two Functional Directors may be co-opted. But they will have no right to vote and do not count as members of the Managing Committee.

No office bearer is allowed to have any financial, transactional or vested interests with regards to the society, unless the financial transactions involve giving residential accommodation to the paid member of the society.

Societies with less than 200 members conducting independent elections are liable for a Rs 25,000 fine if they fail to produce accounts, documents, or paperwork to the government or the members of the society.

Who cannot become committee member of housing society?

Members with questionable moral behaviour, defaulted payments within three months of written notice, Associate Member without NOC from original member are not eligible. Anyone who sublets or rents their house without notifying the society in advance is also not eligible.

Anyone who fails to furnish valid bookkeeping/expenditure records with respect to the funds provided by the society is not eligible. Anyone who neglects their assigned duties and is deemed to be in breach of trust is not eligible to be part of the committee.

Over and above that, if a member has failed to attend any three consecutive monthly meetings of the Committee, without leave of absence, he is disqualified from the Committee.

Retired members who have not been disqualified are eligible for election.

Co-operative society election rules and process

The housing society election rules requires one to declare the initial procedures to the voters by the Managing Committee ( or the Provisional Managing Committee in case if the first Election is to be conducted) at least three months prior to the Election date.

A Returning Officer should be appointed to carry out the Voting Procedures and ensure adherence of the rules. A Returning Officer should be someone who is not contesting the Election in any capacity. Nor should he be proposing or seconding a candidate. In other words, he should be an absolutely unbiased and trusted individual. Usually, someone takes up this position voluntarily. Otherwise, members jointly entrust the responsibilities on a member they deem fit for the duties. In many cases, a financial compensation is made to the Returning Officer for his professional services.

The Conduct of Election should involve the following steps that make the entire procedure methodical and hassle-free. Each process should be published on the Notice Board of the society within ten days of displaying the final list of the voters.

| Steps | Requirement |

|---|---|

| Date of declaration of election programme | Date to be announced at the time of declaration of programme. |

| Last date for making nominations | 5 days from the date of declaration of election programme. |

| The date of publication of list of nominations received | As and when received till the last date fixed for making nominations. |

| Date of scrutiny of nominations. | Next day of the last date for making nominations. |

| Date of publication of list of valid nominations after scrutiny. | Next day after the date of completion of scrutiny. |

| Date by which candidature may be withdrawn. | Within 15 days from the date of publication of list of valid nominations after scrutiny |

| Date and time during which and the place/ places at which the poll shall be taken if necessary. | Not earlier than 7 days but not later than 15 days from the date of publication of the final list of contesting candidate (time and place to be fixed by the Returning Officer). |

| Date, time and place for counting of votes. | Not later than the third day from the date of which the poll shall be taken (Time and place to be fixed by the Returning Officer). |

| Date of declaration of results of voting. | Immediately after the counting of votes. |

If the paid up share capital of the said society is more than Rs. 10, 000, the voting is conducted by secret ballot.

At the time of the voting, each member is shown an empty ballot box before they cast their vote. The Ballot Paper usually has the seal of the society and the counterfoil the initials of the Returning Officer. The Ballot Box is sealed in front of the voters and all the documents/votes relevant to the Election are stored safely by the Secretary who is required to preserve them for three months and then destroy them afterwards. This is done in case of disputes.

After the results, the current committee hands over the charge to the newly elected committee.

In summary, timely execution of required procedures is quite essential to carry out an Election successfully. At each step of the way, the members need clarity and transparency from the elected members . At the same time, members need to be proactively involved in the election procedures as it is commonly observed in many housing societies that the same individuals are selected as office bearers in every term. This may lead to lethargy, inefficiency, or malfeasance in many cases.

Important points to note regarding housing society elections

Equal voting right: In general, each member of the housing society who owns a property has equal voting rights. In general, a member with a larger flat, say 3BHK, does not have a higher voting weightage than someone with a smaller flat, say 2BHK. A person who owns two flats in the society, on the other hand, gets two votes. Votes are usually cast based on the number of units rather than the number of members. In exceptional societies formed as limited liability companies rather than cooperatives, voting rights vary depending on the size of the unit. The Right2Vote eVoting platform allows you to create all types of elections, including those with weightage based on the number of units and weightage based on the size of the flat.

Voting rights of owners: All members of the housing society who own property have the right to vote. No member should be denied the right to vote. In most cases, the first owner has the right to vote, but co-owners may be allowed to vote as well.

Denial of voting rights: A bylaw may state that members who have not paid their society dues in full may be denied voting rights.

Tenant voting rights: In general, tenants do not have voting rights. Each flat’s voting rights are limited to the flat’s owner.

Voting window: To vote, a voter must be given a reasonable voting window. Keeping a very short voting window is restrictive and may lead to members complaining that their right to vote was denied. We recommend a minimum voting window of 8 hours if all of your voters are in India, and a minimum of 24 hours if your members are located outside of India to account for different time zones. In general, many societies keep a voting window of less than 2 hours, which can lead to legal issues.

Reasonable notice of election date and voting window: All voters should be given advance notice of the elections. In general, a minimum of 14 days advance notice is required. However, depending on the bye law, it can vary from society to society.

Intimation of election date and process: A society must notify its members in advance of its intention to hold elections and solicit nominations for various positions. This is usually done at least 21 days before the election date. The rules and procedures for nomination and election must also be distributed by the society.

Right to stand in elections: All owners/members have the same right to vote in elections. No owner can be denied the right to vote unless:

- the owner’s title to the property is in dispute.

- The owner has not paid all of the society’s dues.

Election method: The Acts or model bye laws have generally been silent on the election method, so both paper-based voting and online voting can be used. A show of hands is generally not recommended, especially when a’secret ballot’ is required. More information on this topic can be found on this blog.

Secret ballot: Most State Cooperative Acts and model bylaws state that members should be elected by secret ballot. Nobody, not even the election officer, should be able to tell which members voted for which candidates using a secret ballot. This is to ensure secrecy of member’s vote so that member can vote with his free will and there is no chance of coercion.

Proxy voting: The majority of Acts and model bylaws state that “members should vote in person.” This means that proxy voting is not permitted. It should not be confused with the requirement of voter physical presence. It simply means that a voter cannot delegate his or her voting rights and responsibilities to someone else. Proxy voting clauses differ from society to society; please carefully review your bylaws for the same.

Postal voting: Many Acts and bye-laws expressly provide for postal voting, in which members can vote by mail. However, due to election deadlines, postal voting is generally not feasible, and online voting is a preferred option for voters who live elsewhere or are traveling.

Election of Committee Members: Rules differ in model byelaws relating to election of committee members. In a few states, such as West Bengal, members vote to elect committee members, and the committee members decide who will hold the titles of President, Treasurer, Secretary, and so on. Members in other states, such as Karnataka, vote directly to appoint specific candidates to positions such as President, Treasurer, Secretary, and so on. Members in other states, such as Karnataka, vote directly to appoint specific candidates to positions such as President, Treasurer, Secretary, and so on. A few members are also elected to the committee. Right2Vote’s eVoting platform includes ‘Team Election – Exact’ and ‘Team Election – Upto’ features to assist societies in electing a team of committee members from the same list of candidates. Check your bylaws to see if voters can choose an exact number of candidates or if they can choose fewer than the number of positions. Both customizations are available on the Right2Vote platform. This feature is not available on the majority of other platforms.

Central Goods and Services Tax is an indirect tax to be paid by end-users for the consumption of goods and services. It was implemented in 2017, and it applies not just to individuals and corporations, but to housing societies as well, with exceptions, of course.

To understand in-depth the correct eligibility criteria for a housing society’s liability towards GST, here’s a comprehensive guide that covers all essential information and facts you need to know about co-operative society compliance with GST rules.

What is GST & inclusion provision under the Act

| Act | Inclusions/Definitions |

|---|---|

| CGST Act 2017 Section 7 | “Supply” includes all forms of supply of goods or services or both, such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business. |

| CGST Act 2017 Section 7 And Section 2 (17 e) | States “business” as “Provision by a club, association, society, or any such body (for a subscription or any other consideration) of the facilities or benefits to its members. |

GST Act applicability to housing societies

1. As per Section 2(84) “Person” includes

a co-operative society registered under any law relating to co-operative societies or a Society as defined under the Societies Registration Act, 1860. A cooperative housing society is to be considered as a ‘person’ under the definition of ‘supply’.

2. As per Sec 2(31) “Consideration”

in relation to the supply of goods or services or both includes (a) any payment made or to be made, whether in money or otherwise, in respect of, in response to, or for the inducement of, the supply of goods or services or both, whether by the recipient or by any other person but shall not include any subsidy given by the Central Government or a State Government.

Housing society registration under GST

As per Section 22, if the turnover of the housing society is over Rs 20 lakh and/or it levies more than Rs 20 lakh in aggregate annual maintenance charges in a financial year, it needs to take registration under GST laws and obtain a registration number, but the payment of GST depends on other parameters (covered below).

However, there are exceptions for Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand, where the threshold limit for registration liability is Rs 10 lakh.

Criteria for applicable GST payment for society maintenance

If the society’s monthly maintenance bill is more than Rs 7500 per house, 18% GST is applicable on the entire amount.

If a person owns more than one residence in a society, then a ‘separate’ ceiling of Rs 7500 is considered as the second unit also gets an individual exemption of Rs 7500.

However, there is an exemption if the annual aggregate turnover of the housing society is not over Rs 20 lakh.

Thus, for GST to apply, two criteria must be met.

| Annual turnover of a housing society | Monthly maintenance charge | GST |

|---|---|---|

| ₹20 Lakh or less | ₹7500 or less | Exempt |

| ₹20 Lakh or less | More than ₹7500 | Exempt |

| More than ₹20 Lakh | ₹7500 or less | Exempt |

| More than ₹20 Lakh | More than ₹7500 | Applicable |

Furthermore, GST doesn’t apply to the difference amount alone. For example, if the monthly maintenance bill is Rs 9000, GST will apply to the entire amount, not just to Rs 1500.

Property Tax, Water Tax, Municipal Tax, Non-Agricultural Land Tax paid to the state are exempt from GST.

Sinking Fund, Maintenance and Repair Funds, Car Parking funds, Non-Occupancy Funds, interest from late payments, are not exempt from GST since they are considered charges collected by the society for the supply of services to members.

Let’s understand this in detail for clarity.

Inclusions and exclusions for the societies that fall above the limit of Rs 7500

1. Sinking fund

It is considered a type of service provided by the housing society to its residents hence included.

2. Repairs & maintenance fund

This falls in the category of residents paying for repairs, common services, audits, maintenance dues, etc., thus it’s to be considered as inclusion as it falls under taxability.

3. Non-occupancy charges

These are not considered a part of the Property Tax for common premises, hence included.

4. Parking charges

The same logic applies for parking charges since it’s an individual collection for a specific service.

5. Water charges

If the water charges are collected on behalf of the members by the society for individual use (e.g. water tankers or government source), then they don’t fall under taxation under GST limit as tax may already be applied on it as per the law. If the water charges are for common use,l (e.g. generating electricity to give drinking/potable water facilities as a service), then they’re included under the Rs 7500 limit.

6. Property tax

Property tax on common areas is to be considered as an inclusion in the limit as well. However, if the society is only an intermediary, collecting individual residents’ property tax and handing it over to the government, then it’s not considered under the limit. Property Tax on any other places, like stores and parking spaces (if applicable) should be subject to respective law but not included in GST calculations.

7. Share transfer fees

At the time of property sale share transfer fees are charged which are taxable, which is why they are not included in GST.

8. Common services

Services like the clubhouse, gym, pool are considered taxable, hence must be utilised under GST calculations. If a society uses common spaces like clubhouse, garden, terrace or any other part of the premises for use of members and outsiders on rent, for hire, it’s liable for tax, hence must be covered under the calculation slab.

9. Income received as interest on defaulters

It is considered an individual charge and not used for common uses, thus it’s excluded from taxation consideration.

10. Income received from renting space

Income received from renting space for mobile towers is derived from business, thus it’s to be included in the calculation.

Input tax credit for society

ITC is the tax reduction that you can claim since you’ve already paid on the goods and services. For example, if you’re a housing society who has paid for pipes and construction materials for repair and maintenance of your premises, or have hired the services of an Auditor for your annual accounts, you can claim the credit upon it.

Housing Societies will avail the benefits of ITC which means that if they pay taxes on repair and renovation, capital goods (generators, lawn furniture, water pumps, etc.) and other goods (taps, pipes, hardware, construction materials), they will receive a tax deduction but for them to avail this benefit, the reverse charge mechanism will apply on all goods and services received by suppliers; the set-off can be claimed against the tax liability for maintenance funds.

However, this benefit is available if the amount charged for these supplies is over Rs 7500 per member.

A housing society can impart the benefits of Input Tax Credit by lowering the maintenance charges for members, the amount of which can be determined after proper cost analysis and comparison of output/input tax amounts against overall expenses and income.

What are the requirements for claiming ITC for housing society?

- Society should have the tax invoice

- Goods/services procured should be received, and if they’re being received in installments, the last installment should be received before claiming ITC.

- Tax Returns should have been filed by the society

- The supplier of goods/services has paid the tax being charged to the government.

- ITC is not allowed if the depreciation has already been claimed on the tax component of capital goods/services.

Periodic filing & compliance rules for housing society

A housing society has to file 37 returns, three returns per month, which include:

- Billing Side – 10th of the following month

- Expense Side – 15th of the following month

- Consolidated Return – 20th of the following month

- As well as: One Annual Return GSTR 9 by the end of 31st December next year (for the year 2019-2020 by 31st December 2020)

If a housing society deducts TDS, then they have to file GSTR7 by the 10th of the following month. Housing Societies do not fall under the Composition Scheme.

MC/RWA are expected to maintain proper records of all Supply and Expense reports for 72 months for auditing purposes.

Different GST forms & their importance

- GST 1 – to be filled by all regular taxpayers who are registered under GST, including casual taxable persons (with debit/credit notes, invoices of outward supply).

- GST 2A(&B) are view/read-only available and relevant for the recipient or buyer of goods and services, and can be referred to when any invoice is missing, the buyer can communicate with the seller to upload it in their GSTR-1. No action can be taken on GSTR 2. 2B contains constant ITC data for back referral.

- GST 3B (3 not in use currently)- This is also to be filled by all normal taxpayers, including societies, to provide details of supplies made, ITC claims details, tax liabilities, and payments.

Housing societies should ensure that sales/supplies and ITC details are reconciled with GSTR 1 and GSTR 2B every tax season before filing GSTR 3 B.

Frequently asked questions

It’s Goods and Services Tax, which is levied on the supply of goods and services and is a value-added tax levied on most goods and services sold for domestic and commercial consumption.

No.

Yes. GST exemption and application apply to property used for commercial purposes.

Yes. If the vendor’s services fall under GST rules, the society has to pay as per the percentage applied. E.g., GST payable for contractor services.

In this case, GST applies only to the second apartment for which the maintenance is Rs 8000.

How does this affect maintenance bill/other bill formats?

The society has to add GST to the monthly, quarterly, and yearly invoices and mention the GSTIN No on all invoices where applicable.

What forms are to be used for monthly filing?

Monthly GST forms are GSTR 1, GSTR 2A,and GSTR 3.

On what repair and maintenance services is Input Tax Credit allowed?

On services such as lift AMC, Housekeeping, Security, Fire AMC, Contracting Staff, Accounting and Auditing Services, etc.

What should be excluded while calculating the limit of Rs 7500?

Property tax, electricity charges collected from individual flat owners and other statutory levies are excluded.

What should be included while calculating the limit of Rs 7500?

Water/electricity charges for common areas and common services like clubhouse, swimming pool, along with parking charges, common property tax, payments for repair and maintenance, security, admin, accounting, Non Occupancy charges.

Are share transfer fees/ interest on late payment included in the limit of Rs 7500?

No. Share Transfer Fees are taxable but not included in the Rs 7500 limit as no third party is involved. Similarly, interest on default is an individual charge, so it’s taxable, but not covered under the limit of Rs 7500.

Does GST apply to housing societies?

Ever since the changes in Budget 2021 were introduced, all types of cooperative housing societies are included under GST applicability as they provide services to the members. However, exemptions apply.

It’s 18% (State GST is 9% and Central GST is 9%).

What are the documents needed?

a) In general, invoices issued by the supplier.

b) An invoice such as a Bill of Supply if the amount is less than Rs 200 or if reverse charges mechanism applies.

c) Bill of Entry or similar documents issued by the Customs Department (if applicable)

d) Bill of Supply issued by the supplier

e) Other documents required in the Form

Is GST applicable to maintenance charges paid by residents?

Maintenance charges up to an amount of Rs. 7500 per month, per member, are exempt from GST. Earlier, the exemption was available on a monthly maintenance charge of up to Rs. 5000 per member. The limit was increased to Rs. 7500 with effect from 25th January 2018.

How does the GST exemption work if a person owns two or more flats in a housing society?

In such case, GST exemption of Rs. 7500 per month, per apartment, shall be applied separately for each apartment owned by him.

For example, if a person owns two residential apartments in a society and pays Rs. 15000 per month as a maintenance charge (calculated at Rs. 7500 per month, per apartment), the exemption from GST shall be available to each apartment.

How is GST payable in societies where maintenance charges exceed Rs. 7500 per month, per member?

In case, for society, the maintenance charges exceed Rs. 7500 per month, per member, the entire amount is taxable.

Let’s understand this with an example. If the monthly maintenance charges for a housing society are Rs. 9000 per member, the GST @18% shall be payable on the entire amount of Rs. 9000 and not on Rs. 1500.

* Refer to the latest GST circular issued by the Government of India, Ministry of Finance Department of Revenue (Tax Research Unit), New Delhi.

How does the GST calculation work (with example)?

| Total amount received | Water charges | Sinking fund | Taxable |

| 8000 | 500 | 500 | 7500 |

| 4000 | 500 | 500 | 0 |

What is the procedure to claim ITC and how much can be claimed?

Taxpayers should enter the ITC amount in their monthly, quarterly, yearly GST forms (Form GSTR-1,2,3) and enter details like amounts eligible and ineligible for ITC and reversal, etc. as mentioned in the form. The recipients can claim provisional input tax credit in GSTR-3B to the extent of 5% instead of earlier 10% of the total ITC available in GSTR-2B for the month.

Where can society view the seller’s uploaded invoices?

Invoices uploaded by the seller in GSTR-1 can be viewed by the purchaser in his GSTR-2B form.

Once you are the rightful owner of a residence in a housing society, you are part of a larger, more inclusive, white picket fence community. Homeownership is not only a matter of pride and joy but a lifelong commitment that comes with a regular cost in form of apartment & society maintenance charges. This, however, should not be perceived as a cause for concern but be regarded as an essential investment you make for a comfortable and practical living experience. While a sizeable number of online and offline resources would have you believe that maintenance charges of society are a complex and necessary evil, we’d like to assure you that not only are they easy to comprehend but also mostly justified and in compliance with the law. Let’s find out what are the society maintenance rules.

What are maintenance charges?

It is the fixed amount residents pay monthly to the society for the upkeep of the common areas in a gated housing society.

Types of society maintenance charges

In India, model bye-laws vary from one state to another, albeit the basic anatomy is the same. The most detailed guidelines on maintenance charges are set forth by the state of Maharashtra, permutations and combinations of which may be followed by other states.

The charges can be categorically divided as shown below: (Keep in mind that these are guidelines provided by the bye-laws, however based on different calculation systems, each society determines how much each member pays as maintenance charges… more on that later).

1. Service charges

These include any charges incurred to acquire services and amenities, including but not limited to electricity for common areas, watchmen, lift operators, cleaning crew, and gardeners. Service charges are borne equally by all members.

2. Repair and maintenance charges

These include taking care of all elements of the building such as internal roads, pumps, drainage, lift, tanks, generators, street lights, security equipment, among others. Rates are determined by the society’s governing body; subject to the minimum of 0.75% per annum, of the construction cost of each flat for meeting expenses of normal recurring repairs.

3. Parking charges

Applies to those who own vehicles. Charges depend on the rates fixed by the society (usually vary for two-wheelers and four-wheelers).

4. Water charges

Mandatory for all residents, the charges are based on the basis of total number and size of inlets provided in each flat.

5. Non-occupancy charges

An amount to be paid even if you are not currently residing in the house/flat, however, these charges should not be more than 10% of the service charges.

6. Sinking Fund

Emergency fund for unforeseeable situations is determined by the governing body of the society, subject to a minimum of 0.25% per annum of the construction cost of each flat.

7. Property Tax

Decided by local authority, but not applicable outside Maharashtra since it is directly paid to the government

8. Interest on defaulted payments

If you make late payments, you are liable to pay an interest on defaulted dues. Charges vary from society to society, but are subject to a maximum of 21% per annum on the charges.

9. Insurance charges

Certain expenses for insuring the building and equipment may have to be paid (based on the built-up area of the flat) as part of the maintenance bill. You don’t have to pay the insurance premium for shops/flats used for commercial purposes by others in the building.

10. Lease/rent charges

This is based on built up area of each flat / unit.

11. Other charges

As decided by the governing body of the society as and when needed.

Is it mandatory to pay maintenance charges?

If you are in an independent apartment ownership, every amenity or service you require, you pay out of pocket but are not subject to an annual or monthly maintenance charge. In case of housing societies, it is mandatory to pay society maintenance bills as you are agreeing to be a part of a larger, co-operative construct. As soon as you are a registered member, a maintenance contract is signed by you and the builder, making both parties legally liable to fulfil their respective duties.

Once the builder hands over the affairs to the society, the managing committee takes over the handling of services. Paying maintenance charges is a valid and preferable arrangement as you don’t have to pay for large amounts of money alone in order to avail common services; the cost is shared by all members. Besides, a reasonable amount of flexibility is offered to members in terms of payment options and frequency.

Criteria for charging maintenance

Ideally, maintenance costs are charged per square meter of the unit or apartment. Fees for services such as cleaning, garbage collection, use of equipment, repair and maintenance of common facilities such as elevators are shared equally among all unit residents. However, utility costs (water and electricity) are billed according to individual usage.

How are maintenance charges calculated?

For a number of reasons, maintenance charges is a hotly contested topic in housing societies since there seems to be a general ignorance or discontent about how they are determined. As we perused above, each charge has a calculation based in logic, the details of which can be easily availed from the managing committee. But the law doesn’t concern itself with the issues of fair levying of charges as per the size of the residence and the utility of services. However, since the co-operative is a collaborative effort, every resident’s grievance or discomfort is duly noted and rightly resolved by the use of different calculation systems.

Let’s explore them in detail.

1. Charges based on per square feet

This system of calculation is used when the size of apartments are different. Your maintenance charges will depend on the total number of square feet in your apartment. For example, if the committee decides to levy Rs 2 per square feet and your apartment is 600 sq feet, you will pay Rs 1200. But if your apartment is 1200 square feet, you will pay Rs 2400. The downside of this method is that if apartments with larger sizes end up paying on the basis of square feet, they may have to pay a larger share towards maintaining and repairing common services for which smaller-sized apartments will pay less, even though the utility and access may be the same.

2. Equal Fee

This is the ideal method to calculate maintenance charges when the sizes of all apartments is either exactly the same or approximately the same. In this method, the total maintenance charge to be collected per month is added and then equally divided among all residents, thus ensuring a fair and square deal for all. This is simple to calculate and dispute-free but does not appear as an impartial method if the apartment sizes are largely diverse from one another.

3. Hybrid fee

This method is a combination of the above two types, doing away the need to choose one or the other, thus providing absolutely fair treatment to all members. In such a method, square feet based charges are applied to one clubbed component, say repair and maintenance charges and sinking fund. At the same time, equal fee calculation is applied to the other categories of charges such as service fees, lift expenses. Categories other than that already have specific and precise corresponding guidelines given in the model bye-laws. Applying a hybrid method is highly effective in case of fair and unbiased distribution of maintenance charges.

How often do you have to pay maintenance charges?

There are four payment cycles you can adopt – they are (1) annual (2) bi-annual (3) quarterly (4) monthly payment cycles. Housing societies decide upon one of these payment frequencies at the very initial stage and can make changes later. They have to consider factors such as timely payments of service/utilities, how many members are willing to pay maintenance in bulk amounts and ultimately, which is the easiest payment frequency with respect to collection and record-keeping.

It is always recommended to stay on top of your maintenance charges to avoid late payments, which result in added interest. Paying your maintenance charges on time also establishes you as a responsible resident. However, be sure to examine any expenses that look out of place and bring them to the management’s notice promptly.

How often do you have to pay maintenance charges?

Any society or apartment maintenance charges rules have a direct effect on the life cycle cost of a property. Investors investing in commercial property or MNCs have a good understanding of maintenance charges. The society maintenance charges are higher in commercial properties than in residential ones, as the former will have components such as central air conditioning and larger common areas. But when it comes to people buying homes, not everyone is aware or understands the impact of maintenance charges on flats. This is one thing developers also don’t care to explain or talk about.

For projects that are still under construction, the maintenance charges may not be demanded initially and may not be discussed in detail. However, for a property that is ready to move in, all the charges, including apartment maintenance charges and various deposits, are required to be paid upfront and hence, the home buyer learns about it. The disclosure of apartment maintenance charges impacts a buyer’s decision.

GST on Maintenance Charges

On 22 July 2019, the Government issued Circular No.109/28/2019– GST on ‘Issues related to GST on monthly subscription/contribution charged by a Residential Welfare Association (RWA) from its members’ according to which maintenance charges/subscription charges paid by residents to the Resident Welfare Association* are exempt if the amount charged does not exceed INR 7,500 per month, per member (prior to 25 January 2018 the limit was INR 5,000). However, if these charges exceed INR 7,500, GST on annual maintenance charges is chargeable on the entire amount charged.

Maintenance charges/subscription charges paid by residents to the Resident Welfare Association* are exempt if the amount charged does not exceed INR 7,500 per month, per member (prior to 25 January 2018 the limit was INR 5,000). However, if these charges exceed INR 7,500, GST on annual maintenance charges is chargeable on the entire amount charged.

FAQs on society maintenance charges

What if society member is not paying maintenance?

Society may send reminder/notice to the defaulter for the payment of society maintenance. If the dues are still not paid by the defaulter then society can file a case against the defaulter at the office of deputy registrar of cooperative housing society.

Should I pay maintenance if my flat is empty?

It majorly depends on the bylaws set by your society. If as per the bylaws of society states that all members of housing society have to pay maintenance changes weather flat is occupied or empty. Then as a resident of housing society you have to pay maintenance charges.

What do you mean by maintenance charge?

To maintain the services and amenities present in the premises, a cooperative housing society may chanrge a certain amount as maintenance charge.

Can society increase maintenance charges at any time?

The society cannot demand service and other charges which the society charging from the members and similarly contribution of the

expenditure to be incurred for the repairing of society as per resolution in the managing committee meeting only. It is obligatory to take approval of general body meeting in this regard and to take action as per resolution of general body meeting.

Can maintenance charges be waived off?

Under exceptional cases, a society can waive off maintenace charges for a stipulated period of time.

Book a demo now

How does a Society finance itself? How does it screen potential members? Why does it bill its members maintenance charges? Where and when does the member voice his concerns or opinions?

These questions must have popped in your head time and again as a member of a housing society. Look no further than the inconspicuous little book of ‘ Society Bye laws ”.

What are bylaws for a housing society?

Society Bye-laws are rules formed by residential societies to self-regulate their activities and to control the actions of its members. Housing society bye laws are provided and approved by higher authorities (government bodies, legislative authorities). Society Laws could vary from one state to another in their particulars, yet the basic framework and nomenclature remain the same. Let’s briefly explore distinctive categories for each component of the functioning of a society. These are broad categories that cover every aspect of housing society rules and regulations, be it holding a meeting, issuing shares to members, collecting dues from them, conducting Elections, allotting parking spaces or putting out a circular on the notice board.

Purpose of housing society bye-laws

The managing committee of an Apartment Owners Association (or Residents Welfare Association) must have bye-laws in order to ensure adequate upkeep of the apartment building and to swiftly and effectively address the problems residents encounter. Escaping the problems is difficult. Convincing the society to accept the chosen laws and regulations is a challenging endeavour. A set of regulations known as the bye-laws provides a solution to all associated problems. The bye-laws are adopted by each apartment building as soon as it registers. The bye-laws are regarded as the apartment complex’s constitution and regulate how it operates on a daily basis.

Why should you know about the model housing society bye-laws?

The answer to any question you have about the functioning of your society can be found in the model bye-laws of housing society . They may seem verbose or cumbersome, but they should be on your ‘essential reading list’ as they are your ‘set in stone’ legal chaperones that cannot be refuted by any society under any circumstances. As part of a society, you’d be remiss if you are not aware of your basic rights and duties, your society’s foundational policies, its management and the guidelines that dictate its decisions. A lot of homeowners harbour an approach of ‘we’ll cross that bridge when we get to it’ with respect to the rules of a society, thinking all is accomplished once they have occupied their residence inside it. Be that as it may, to avoid being misinformed or manipulated by dishonest committee members, to stop the violation of your rights, or simply to be aware of the workings of the community you’re part of, familiarising yourself with model bye-laws of housing society is necessary. Cooperative society bye-laws are easily available online to peruse in your own time. Otherwise, as a member you have the right to ask for a copy from your society.

List of housing society bye-laws

1. Preliminary- name and address

This section informs us about the procedure for naming, change in name, classification, address change procedure and exhibiting the Name Board of the society.

2. Interpretations

The meaning of the nomenclature, i.e the exact definition of commonly used terms (common areas, sinking fund, active member) is given so as to legally distinguish common usage of words in the context of a housing co-operative.

3. Area of operation, objectives, affiliation

To define the locality of the society within a municipality and to define the main objects of the society as well as declare it as Member of the Co-op Housing Federation of the District / Ward / Taluka, the District Central Co-operative Bank of the district.

4. Raising of funds and their utilisation

Cooperative society bye-laws lay down rules on modes of raising money such as issuing shares, taking loans, voluntary donations & deposits, etc. and explains how to issue shares to members and limit of liability for the society. The ways in which the funds are utilised are also described, such as reserve fund, repair and maintenance, emergency fund and training fund.

5. Rights & duties of a member

This section describes the eligibility, conditions, and procedure of obtaining membership in a society distinguishes between active, non-active, associate, and nominal members. The rights of members elaborated under bye-laws of the society include the right to inspect records, get a copy of RWA bye-laws, right to Occupation of Residence, conditions for and acceptance of Resignation by Members, procedure for Nomination by a Member and its revocation / revision, procedure and requisite documents for Transfer of Shares and interest from a member to another in the Capital/Property of the Society, Transfer of Shares and interest of the deceased Member, and rules on Exchange and Sub-letting of residences.

6. Responsibilities and liabilities of members

This section details the duties of the member, including applying for permission to make additions and alterations in a flat, allowing examination of flats and report about repairs, not to cause inconvenience to other members. It also entails the grounds for expulsion from the society and its procedure, circumstances under which a person ceases to be a member and the follow-up action taken by the society, rules on holding multiple flats, liability limited of members to unpaid amount on shares.

7. Society charges

Bye-laws of society describe the composition and break-up of the society charges, including Property Taxes, Water Charges, Common Electricity Charges, contribution to Repairs and Maintenance Fund, expenses on Repairs. Operation and Maintenance of the lifts contribution to the Sinking Fund, Service Charges, Car Parking Charges, Interest on the defaulted charges, Repayment of the Loan, Installment and Interest, Non-occupancy Charges, Insurance Charges, Lease/Rent, Non-agricultural Tax, Education and Training Fund, Election Fund, and any other charges.

8. Duties and powers of the society

These are rules specific to the common seal and incorporation of the society as holding the power to acquire, hold and dispose of the property, to enter into contracts and other legal proceedings. It also pertains to having a charge on the shares and/or interest of a Member, policy for allotment of flats and cancellation of flats, handing over possession of flats, society’s duty to carry out Structural Audit, allotment of parking lots and its restrictions, marking of parking lots and their eligibility, along with payment of charges for parking of vehicles.

9. General meetings (first general meeting, annual general meeting & special general meeting)

This section gives detailed and specific rules on how to conduct society meetings, including general, annual and special body meetings. Rules regarding the agenda of the first general meeting, the duties of provisional committee and its handover to newly elected committee, the functions of the annual general body meeting, rules for special general body meeting, period of notice and quorum of a general body meeting, voting rights of members, recording of the minutes of meeting, holding of the adjourned General Body Meeting, among others are explicitly stated.

10. Management of society affairs

Rules under this category include opening up of bank account for operations, strength (in numbers) of the Managing Committee, guidelines for Election, First Meeting of new committee, duration of holding office, conditions for cessation of membership of the Committee, and Resignation of Committee Member/Office bearer. There are detailed lists of all the required functions of the Managing Committee, Chairman and Secretary of the society.

11. Book-keeping

Detailed lists of maintaining books of accounts, records and registers are specified, including but not limited to cash books, ledgers, Sinking Fund, Investment, Nomination, Loan Registers, Minutes Books, Applications for membership, resignations, correspondences received from within the society or from external agencies related to property tax, conveyance, electricity, vouchers and counterfoils of share certificates and issued cheques, periodical statement of accounts, audit memos, election papers, service staff payment records.

12. Profit distribution

Rules on how to distribute funds (after paying interest on loans/deposits and after making such other deductions) are prescribed clearly in the bylaws of the cooperative society . The allocation includes a percentage of the amount to be deposited in the Reserve Fund, in dividends of shares to shareholders, compensation paid to office-bearers, and towards Common Welfare Fund.

13. Writing off dues

This section prescribes the conditions under which the Society is allowed to write off its irrecoverable charges due from the members, the expenses incurred on recovery and the accumulated losses.

14. Society accounts audit

The basic procedure for conducting an annual financial audit of the society is described in detail, including the appointment of a registered Auditor/CA, the timeframe to conduct the audit and the steps for completing an Audit Rectification Report before Annual General Meeting.

15. Conveyance, redevelopment and repair/maintenance

This section gives details of getting the deed conveyance under society’s name through an advocate and proceeds to list rules on renovation and repair. Member’s contributions towards repair are stated, along with the procedure of inviting tenders from architects/ developers, and a step-by-step guide to the entire redevelopment process is given. Guidelines on emergency planning schemes, disaster management and response machinery are prescribed as well.

16. Other miscellaneous matters

Minor yet important rules regarding day-to-day operational activities are mentioned in the bye-laws of residential society . These include sending and displaying notices on general meetings and their resolutions, how to fix the Notice Board and what to display on it, penalty amounts for member breaches against the society, regulating the services, amenities as per members’ convenience, fixing timings and rules for use of common areas such as parks, staircases, etc, making available spaces for members to install solar energy electrical systems, making copies of the documents required by the members and the charge per page.

17. Committee redressal of member complaints

Based on the complaint type, the society bye-laws give a list of relevant authorities to approach. They describe the types of complaints handled at the Society’s General Body Meeting. Other than that a variety of complaints are handled by the Registrar, Co-operative Court, Civil Court, Municipal Corporation/Local Authority, Police or the District/State Federation, depending on the nature of the grievance.

Differences between old & new housing society bylaws

Do I have to adopt a new set of housing society bylaws if my society is newly registered? True, your society would adhere to the old model bylaws. If it was previously registered, the year is 2009. Bye-laws have been newly modified following the 97th Constitutional Amendment and the MCS Amendment Ordinance, 2013. This includes cash on hand limits, active member provisions and duties, maintenance rates, AGM, society election tenets, and so on.

Several MCs look for the procedure for adopting new bylaws, while others simply look for bylaw amendments.

Societies try to dot the i’s and cross their t’s when it comes to record-keeping and paperwork, but there are some hits and misses every now and then. Many societies forget to (or simply don’t know that they have to) issue share certificates of society to their members on time or use the housing society share certificate transfer form at the time of resale.

Here’s all you need to know about the share certificate of housing society format and the society share certificate transfer procedure.

What is a housing society share certificate?

A society share certificate is a legal certification given by a housing society that a certain member is the registered owner of shares in the cooperative housing society. It is to be given to the member free of charge. Model bye-laws state that, “Share Certificate, prescribed in bye-laws, bearing distinctive number and indicating the name of the member, the number of shares issued and the value paid thereon, shall be issued by the society to every member for the shares subscribed by him, within six months of the allotment of the shares.” The Registrar decides at the time of the society’s registration the total authorized capital, which is divided into Rs. 50 per share, and share certificates are distributed to the members. The member is issued 10 shares (worth Rs 500), as the total share capital need not be the same as the actual number of shares issued.

Why do you need a society share certificate?

While your sale deed is the proof that the property has been legally transferred in your name, a share certificate is legal proof that you are the rightful owner of the co-operative housing society’s shares. The managing committee must issue share certificates after due diligence. According to the society share certificate rules, in the case of a transfer, the share certificates should be issued to transferee within a period of one month of receipt of the instrument of transfer by such Company.

Checklist for issuing the society share certificate

- The society share certificate has to be collected by the member himself in person.

- The member’s property should be clear of lieu.

- The conveyance deed from the builder should be in possession of the society.

- Every housing society’s share certificate should have the seal of the society and be signed by the Chairman, the Secretary and one member of the committee, and authorised by the committee before being issued by the Secretary.

- The name and the order of names (for primary/associate member) should appear exactly as it is on the original sale agreement between the member and the builder.

- The member has to indemnify the society against any loans against its name, finish any paperwork and clear any arrears that have to be paid to the society.

- The society has to ensure that the member provides an indemnity bond stating that he has not transferred the share certificate to anyone else or created any charge or mortgage on the share certificate in favour of any bank, employer, any person or finance agency.

- The member has to present the original sale agreement while collecting the housing society share certificate.

Transfer of share certificates in case of a resale

In case of a resale, if a person needs to transfer the share certificate, all of the paperwork and necessary requirements pertaining to the transfer of shares must be completed on time. It is the new member who needs to pay the transfer premium and ensure that all the dues are cleared by the previous homeowner.

In case of transfer/resale, the original share certificate has to be given to the society along with the other documents needed. If the share certificate is being transferred to a new member after resale, they have to finished all paperwork prior to handing the share certificate, including the required transfer of shares procedures.

When the ownership of the shares is being transferred to another person, the new member has to pay the transfer premium, produce applications/documents required by the society while it has to ensure that no dues are pending by the former member. In the event of the death of the original member, the heirs have to apply within 6 months of the death for the share transfer to the nominee, along with the issuance of a new share certificate of the society.

Readymade share certificate booklets are available online, from housing federation offices or at book printing agencies.

If the members’ arrears are duly paid, and the documents requested by the society are submitted in proper condition, the society MUST issue the share certificate within the prescribed time limit after allotment of actual shares. If not, the member has the right to file a legal notice/injunction against the society.

Issuing a duplicate housing society share certificate

It is advisable to keep your original housing society share certificate in pristine condition in a safe place. Getting a duplicate society share certificate is not as simple as walking into the society’s office and getting a duplicate copy on the same day. If your share certificate is soiled, misplaced, stolen, destroyed, or lost, you can ask your housing society to issue a duplicate share certificate after following the procedure.

- File an FIR at the local police station, registering a report that the original share certificate has been lost, misplaced or stolen. Retain the copy of FIR acknowledged by the Police.

- Send a written application to the society stating that the original has been lost, misplaced, stolen (is not traceable) and request the society to issue a duplicate share certificate. Also, attach the acknowledged copy of the FIR with the application.

- Submit an indemnity bond of Rs 200 to the society, indemnifying the society of all cost/ results of issuing a duplicate share certificate. The Indemnity Bond should be duly notarized and attached along with the application and FIR copy.

- Once the society receives the application, it is placed before the managing committee in the next general body meeting. In the same meeting, the society examines the application and attached paperwork and approves the request for a duplicate share certificate.

- The society puts out the notice on the society’s notice board and also published notices in two local newspapers (with respect to issuing a duplicate share certificate).

- The society waits for 15 days for any objections after putting out the notice on the society’s notice board and the advertisement in the newspapers.

- If no objections are raised, the society issues a duplicate share certificate to the member. The cost of publishing notices in newspapers has to be borne by the member.

FAQs on housing society share certificate

What is the importance of share certificate in housing society?

The ownership of a share certificate is extremely important for a property owner in a cooperative housing society. It acts as a legal document for your rights as well as proves the allotment of shares of that society on your name.

How do I get a share certificate from society?

As a resident in your cooperative housing society, you have to apply for share certificate as per Cooperative Housing Society Act of your state.

What happens if society does not transfer share certificates?

If the housing society refuses to issue a share certificate to member, then he/she can file a legal notice against the housing society if there is no pending bill.

When can society issue share certificates?

After verification of all the submitted documents, society has to issue society share certificate with in 6 month from the date of shares allotment.