Table of Contents

In any residential community, income and expenses must balance. While invoicing brings money in, expense management governs how that money is spent. Every vendor bill, every purchase request, and every petty cash outflow contributes to the financial health of the society. When these are managed in silos, invoices in one file, bills in another, approvals on WhatsApp, committees lose visibility. Payments get delayed, duplicate expenses slip through, and auditors raise red flags.

Mygate ERP brings expense management under one system. It links every vendor payment, purchase order and debit note back to the society’s accounts. This ensures committees know not just how much they have collected, but also where every rupee is going.

The building blocks of expense management

Mygate breaks down the expense workflow into clear modules:

-

- Vendors All service providers and suppliers the society works with.

- Purchase Requests and Orders Requests raised by members or staff, converted into purchase orders after approval.

- Goods Receipt (MRN) Proof that items or services were actually delivered.

- Expense Booking Recording vendor bills against the correct ledger.

- Payments Clearing dues through advances, direct payments or adjustments.

- Debit Notes and Tags Handling returns, disputes and categorising expenses for reporting.

- Multi-level Approvals Ensuring no payment is made without the right checks.

- Budgets and Bank Accounts Planning and reconciling expenses against society funds.

Vendor setup as the foundation

Vendors are the backbone of expense management. Without clean vendor records, bills cannot be booked correctly, IRN requests may fail, and payments may be delayed. Mygate ERP provides a structured Vendor Master where all details are stored.

Fields available in vendor setup include:

- Vendor name, code and category

- GSTIN, PAN and billing address

- Bank account details for payments

- Contact information

- TDS applicability if relevant

This ensures every vendor bill can be validated against accurate master data. It also prevents duplicate vendors from being created under slightly different names.

Why vendor setup matters

Societies often have dozens of vendors — security, housekeeping, gardening, lift maintenance, water suppliers, and more. Without a structured master, bills from the same vendor may be split across different names, making reconciliation impossible. By mandating vendor creation before any bill booking, Mygate ERP ensures:

-

- Payments are made only to approved vendors

- GST returns include correct vendor GSTINs

- Vendor statements can be generated instantly for audits

- Duplicate billing is reduced

Why a structured purchase process matters

In many societies, committees or staff raise requests for supplies and services on WhatsApp or email. With no central log, requests are lost, and expenses balloon without control. Vendors often overcharge, or two different committee members may approve the same work. Mygate ERP eliminates this by creating a three-stage workflow of purchase requests, quotations, and purchase orders.

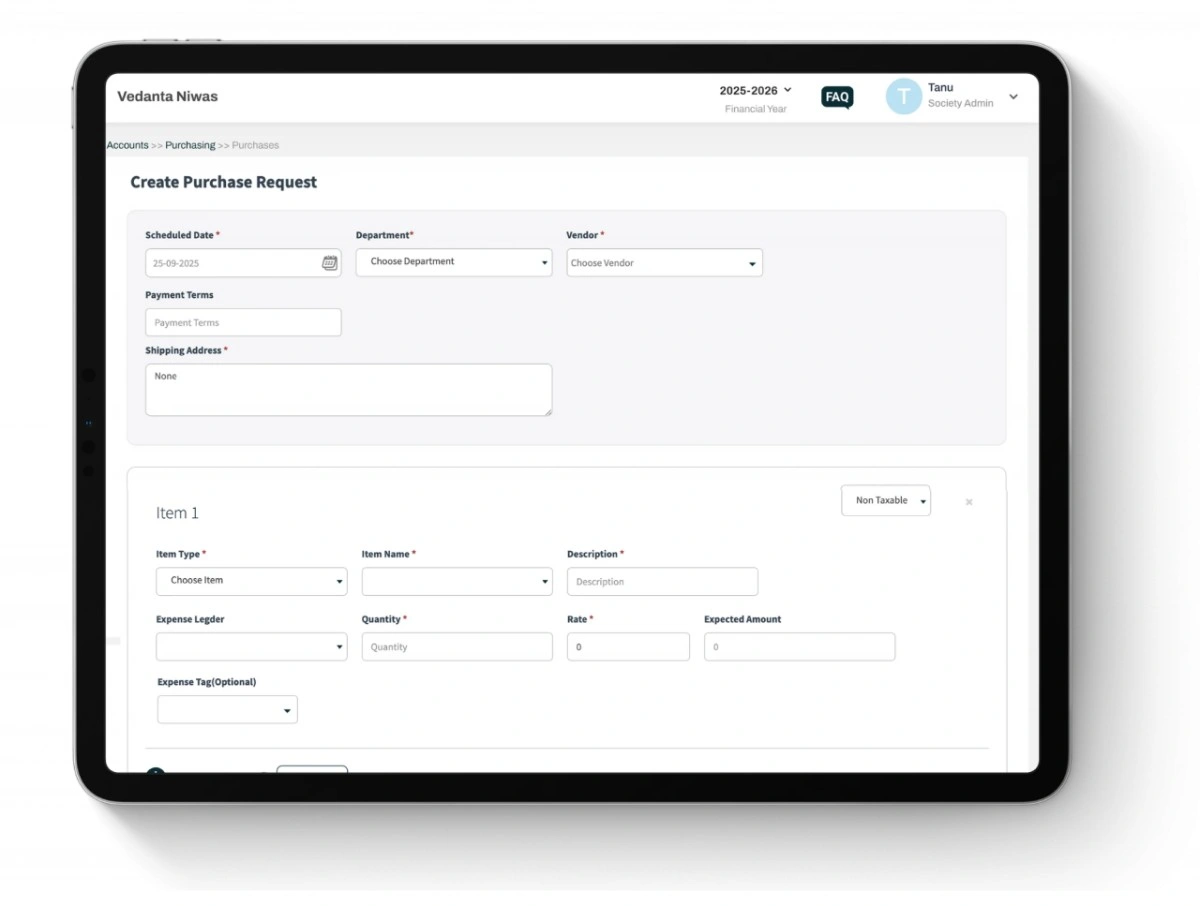

Stage 1: Purchase Requests

Any committee member or staff can raise a purchase request inside the ERP. The request captures:

- Item or service required

- Quantity and expected cost

- Department or category (security, housekeeping, repairs)

- Requested by and date

Admins can then review and approve or reject these requests. This creates an official record that work was proposed, even if it was not approved.

Raise purchase requests with department, vendor, and item details captured in one form.

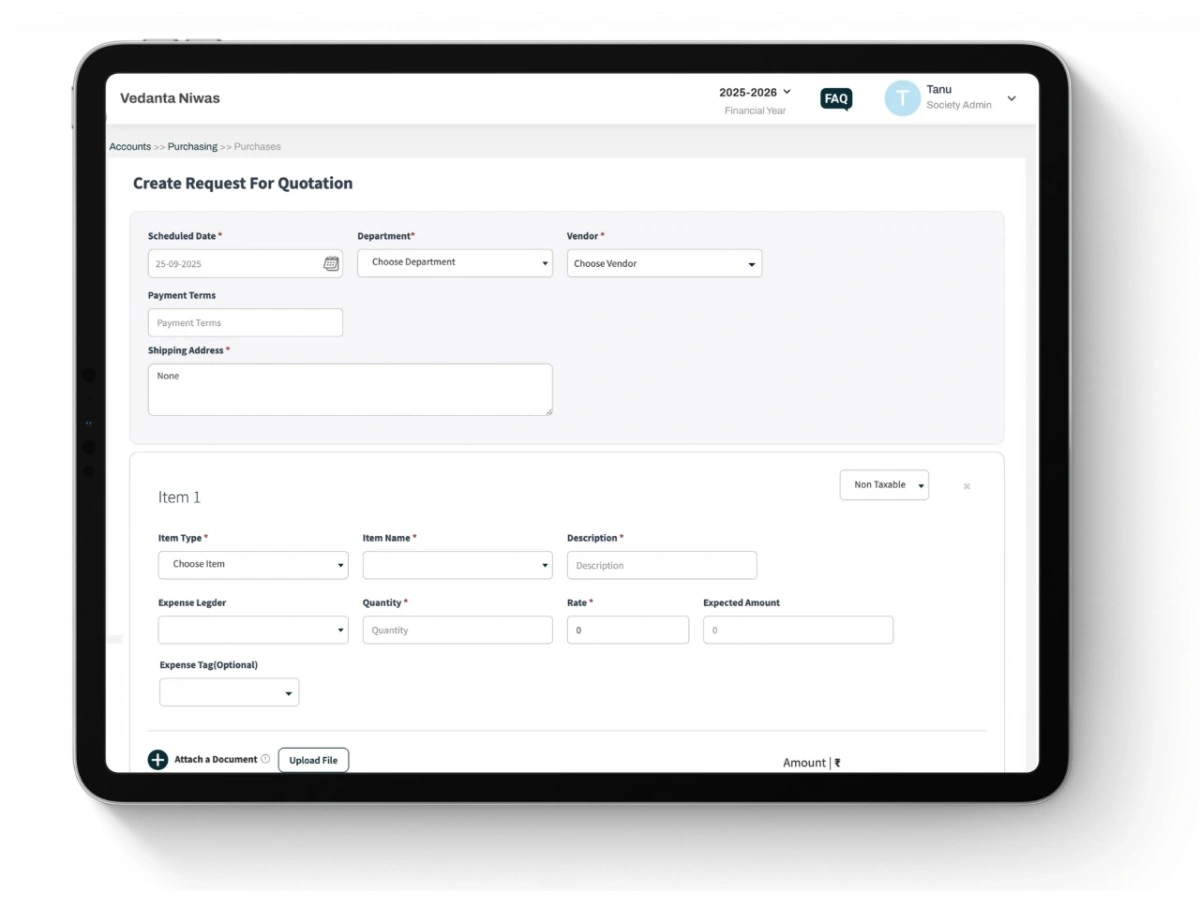

Stage 2: Request for Quotations (RFQ)

Approved requests can be converted into RFQs. This step is particularly important for larger societies where competitive vendor selection is mandatory. RFQs can be sent to multiple vendors stored in the Vendor Master. Vendors then submit their quotes, which can be uploaded or recorded in the system.

The ERP makes it easy to compare quotes side by side. Committees can look at total price, GST, and terms before selecting the winning vendor. This ensures transparency and makes it harder for any single vendor to be favored without justification.

Create & manage purchase quotations with item details, vendor info, expected costs in one place.

Stage 3: Purchase Orders (PO)

Once a vendor is selected, a purchase order can be generated from the approved RFQ. The PO is a binding contract that includes:

- Vendor name, code and address

- Items or services requested

- Quantity, rate and GST details

- Total value of the order

- Expected delivery date

Mygate ERP assigns each PO a unique number and allows download in PDF format. These POs can then be shared with vendors directly. Inside the system, POs serve as the base document for later steps like goods receipt and expense booking.

Why this workflow is important

Without this structured flow, societies risk over-spending and under-documenting. By forcing requests to move through approvals, quotations, and orders, Mygate ERP ensures:

-

- No expense is booked without committee oversight

- Vendor selection is transparent and defensible

- Orders are standardized and auditable

- Bills cannot be booked unless linked to a PO (where mandated)

Why verification before booking matters

A common problem in societies is booking vendor bills without confirming whether goods or services were actually delivered. This creates leakages, double payments, and disputes later. Mygate ERP addresses this by introducing a Material Receipt Note (MRN) step. Bills can only be booked after delivery is verified.

Material Receipt Note (MRN)

The MRN is the digital proof of delivery. When a vendor delivers items or completes a service, the society’s staff or committee member records an MRN in the ERP.

Each MRN captures:

- Linked Purchase Order number

- Items received, with quantity and condition

- Date of delivery

- Person who verified the receipt

If the delivery does not match the PO, the MRN can be flagged and sent for clarification before any expense is booked. This ensures vendors are paid only for what they actually supplied.

Expense Booking

Once MRN is confirmed, the next step is Expense Booking. This is where the vendor’s bill is recorded in the system. The Expense Booking screen includes:

- Expense Booking Number (auto-generated)

- Linked PO or MRN number

- Vendor details (fetched from Vendor Master)

- Vendor Bill Number and Bill Date

- Expense Ledger (for example, cleaning, repairs, AMC)

- Amount and GST details

- Due Date

Admins can also attach scanned copies of vendor bills to strengthen audit trails.

Bulk Upload and Quick Booking

For recurring services like security or housekeeping, multiple bills are generated every month. To save time, Mygate ERP supports:

- Quick Upload: Upload multiple bills in one go using Excel templates.

- Bulk Approvals: Approve and book multiple expenses simultaneously.

This makes it feasible to manage hundreds of bills without missing deadlines.

Status Tracking

Each expense passes through statuses:

- Draft (bill entered but not yet approved)

- Approved (ready for payment)

- Paid (linked to a payment entry)

- Cancelled (if rejected)

These statuses make it clear where each vendor bill stands, so treasurers can prioritize overdue items.

Why MRN and Expense Booking matter

By enforcing MRN before booking, Mygate ERP closes a critical loophole. Societies no longer have to rely on trust alone when processing vendor bills. Combined with expense booking linked to ledgers, every rupee spent is tied back to a PO, an MRN, and a vendor bill. This builds a strong audit trail and reduces vendor disputes.

Why payment tracking is critical

Vendor relationships depend on timely and accurate payments. If societies delay or mismanage payments, vendors may stop services or demand advance settlements. On the other hand, if payments are made without checks, committees risk double-paying or clearing disputed bills. Mygate ERP solves this by making vendor payments fully traceable and tying them back to expenses already booked.

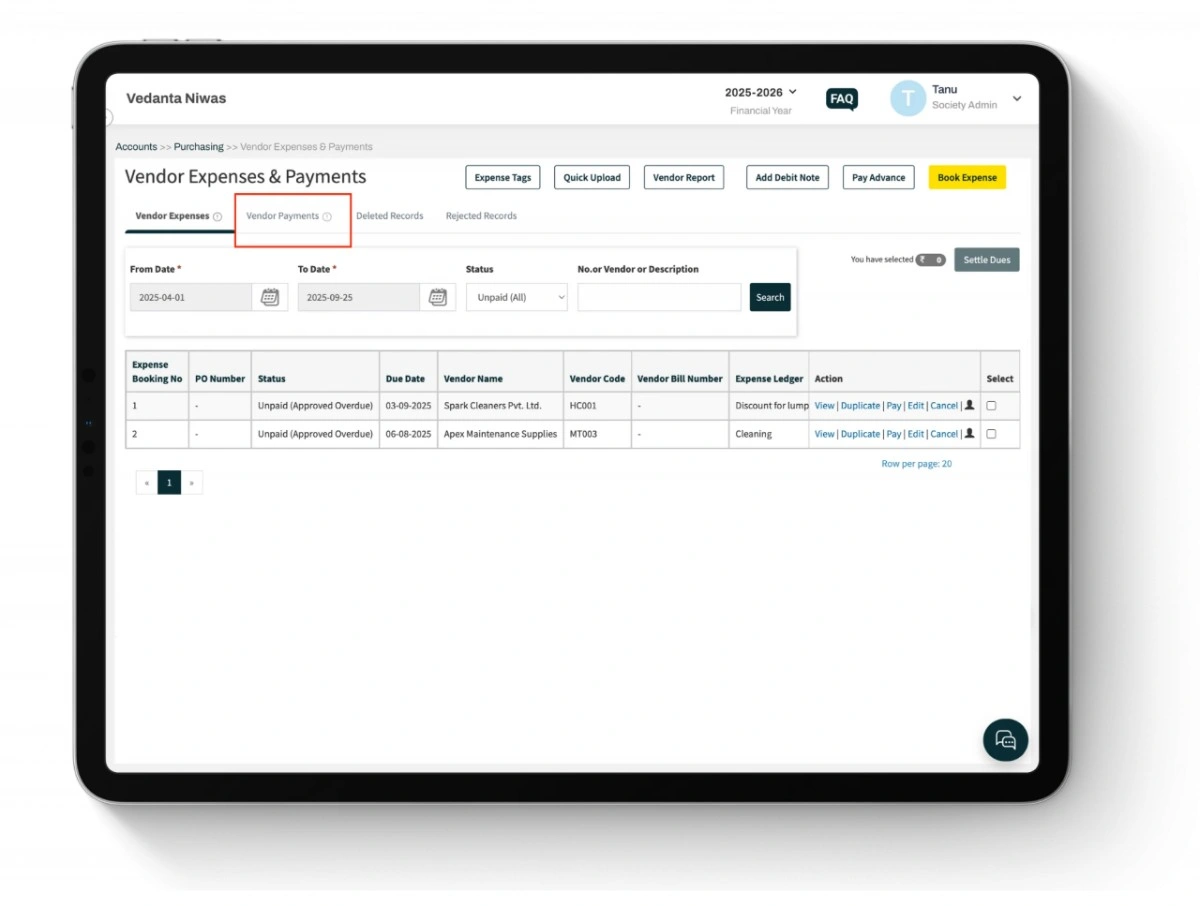

Vendor Payments

Payments can be initiated only against approved expenses. This prevents the committee from paying vendors before bills are validated.

When booking a payment, admins must capture:

- Vendor name (pulled from Vendor Master)

- Linked Expense Booking Number

- Payment method (bank transfer, cheque, cash, Mygate payment gateway)

- Payment date and reference (such as UTR number)

- Ledger mapping for accounting

The system then changes the expense status to Paid, keeping a clear link between invoice, bill, and payment.

Track vendor bills, expenses, and payment status on time from a single dashboard.

Payment types supported

- Direct Payment: Settling an approved expense in one go.

- Advance Payment: Paying vendors in advance for services. These are later adjusted against booked expenses.

- Petty Payments: For small, day-to-day cash expenses (recorded under Petty Expense).

- Bulk Payments: Multiple approved expenses across vendors can be cleared together, saving time for treasurers.

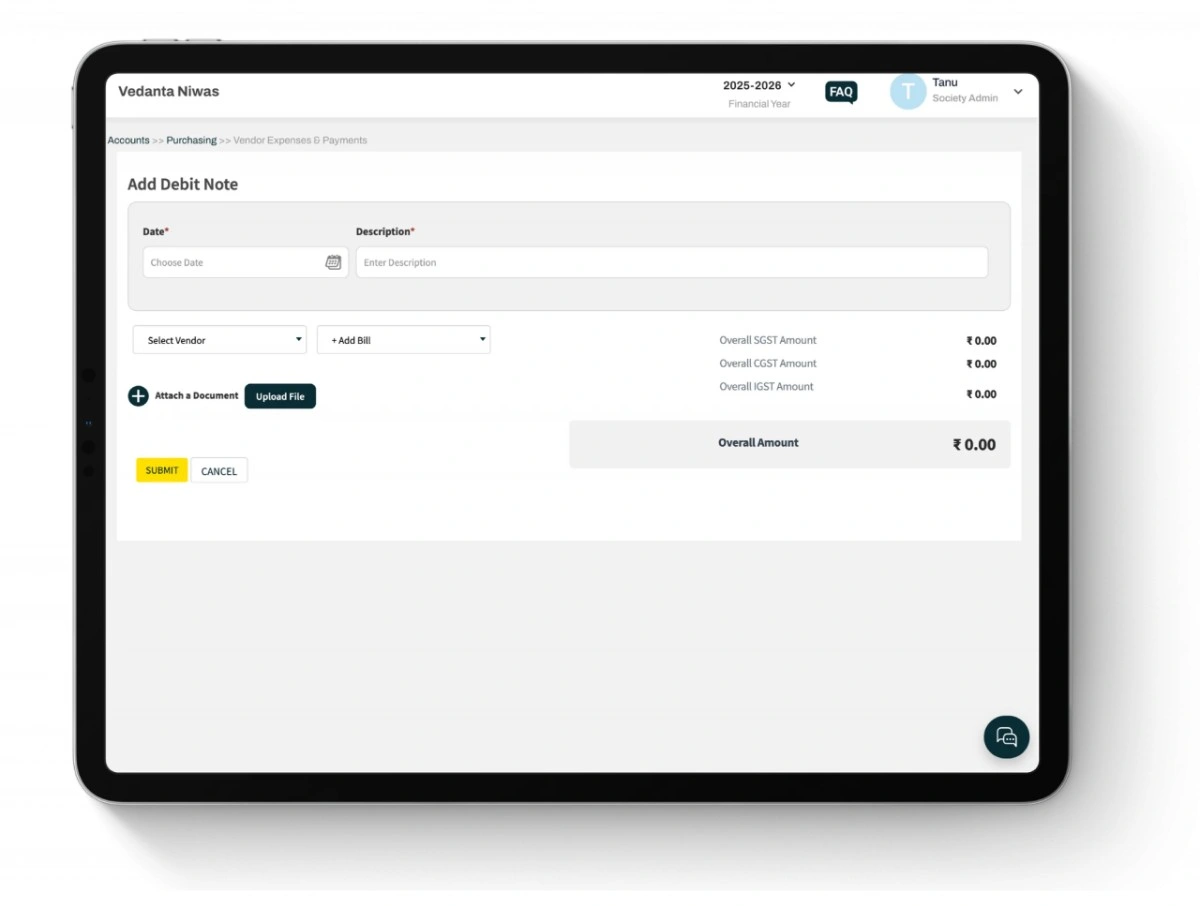

Debit Notes

Not every vendor bill is accurate. Sometimes goods are returned, services are incomplete, or overcharges need reversal. Instead of deleting bills, Mygate ERP allows committees to issue Debit Notes.

A Debit Note captures:

- Debit Note Number

- Vendor Name and Code

- Linked Expense Booking Number (if applicable)

- Reason for debit (return, rejection, overcharge)

- Debit Amount with GST split

- Status (draft, approved, cancelled)

Debit Notes reduce the vendor’s payable balance and are stored in a Debit Note Register for audits. Cancelled debit notes are tracked separately so that every adjustment remains transparent.

Easily create debit notes with vendor details, bills, and supporting documents.

Vendor Account Statement

One of the most powerful tools is the Vendor Account Statement. This acts like a mini-ledger for each vendor, showing:

- All expenses booked

- Payments made

- Debit notes issued

- Current outstanding balance

Committees can generate statements for any vendor and share them as proof in case of disputes. Vendors also benefit because they can see exactly which bills have been paid and which remain pending.

Why this flow matters

By combining strict linkage (only paying against approved expenses), debit note support, and vendor statements, Mygate ERP ensures societies maintain professional relationships with vendors. Payments are never arbitrary, reversals are logged, and every rupee outflow is tied to a transparent audit trail.

Why categorization and control are needed

Expense booking and payments handle the operational side of bills. But committees also need to understand where money is going and make sure expenses don’t cross budget limits. Mygate ERP addresses this with three powerful features: tags, multi-level approvals, and budgets. These features are about control, transparency, and long-term planning.

Tags for expense categorization

Tags act like labels that can be applied to any expense. Instead of only grouping by ledger, committees can create tags for more detailed categorization.

Examples of useful tags:

- Event-related expenses (Republic Day, Diwali, Annual Day)

- Project-based costs (Clubhouse Renovation, Lift AMC)

- Departmental expenses (Housekeeping, Security, Gardening)

- One-off initiatives (Water Tank Cleaning Drive, Waste Segregation Campaign)

Each expense can carry multiple tags. Later, reports can be filtered by tag, making it easy to see how much was spent on specific activities or projects.

Multi-level approvals

Approvals ensure that no expense slips through without oversight. Mygate ERP supports configurable approval workflows:

- Single-level approval: Treasurer or Secretary approves all expenses.

- Multi-level approval: A chain of approvers review and clear expenses step by step (for example, Facility Manager → Treasurer → President).

- Threshold-based approval: Smaller bills may only need one sign-off, while higher-value bills can require multiple approvals.

Each approval is logged with name, date and time. If an approver rejects a bill, it goes back for correction. This prevents unauthorized or hasty payments, while also distributing responsibility across the committee.

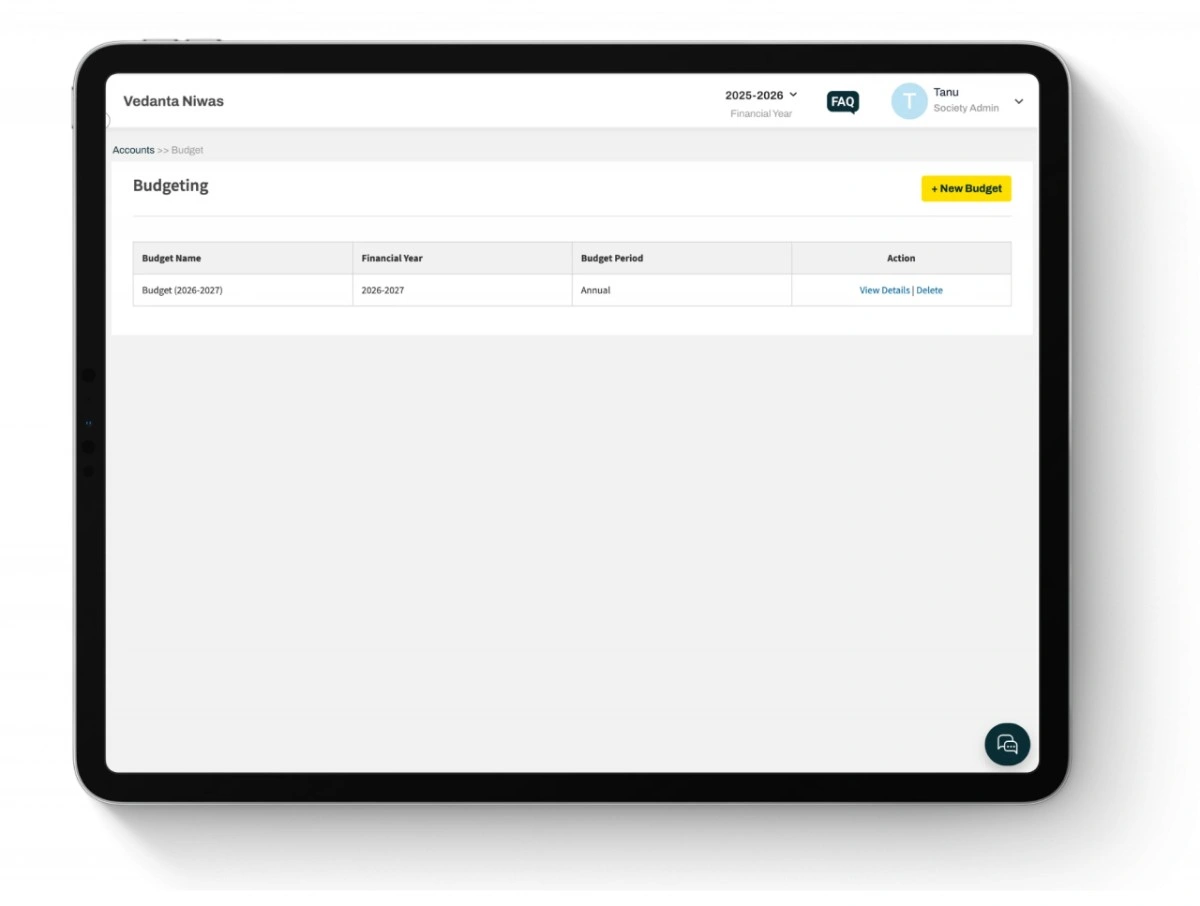

Budgets and budget control

Budgets are where planning meets execution. Mygate ERP allows committees to define annual or monthly budgets against specific heads such as security, housekeeping, maintenance, or utilities.

Budgets in the system include:

- Budget amount allocated for the head

- Actual expenses booked against that head

- Remaining balance available

As expenses are booked, Mygate automatically updates the budget utilization. Reports can highlight:

- Heads that are overspending

- Heads that are under-utilized

- Variances between budgeted and actual expenses

This helps committees take corrective action mid-year instead of discovering budget overruns at the end of the financial year.

Plan and track annual budgets with complete visibility across financial years.

Why tags, approvals and budgets matter together

Tags provide flexibility in reporting, approvals bring governance, and budgets deliver financial discipline. When combined, they ensure that expenses are not just processed but also categorized, checked, and measured against a plan. For auditors, this makes the society’s accounts far more professional. For residents, it gives confidence that their money is being spent responsibly.

Why reconciliation is important on the expense side

While reconciliation is often discussed for resident payments, it is just as critical on the expense side. Societies must prove that every rupee going out of the account matches an approved vendor bill or petty expense. Without reconciliation, payments can be double counted, vendor statements will not tally, and auditors may flag irregularities. Mygate ERP ensures vendor payments and bank balances stay aligned.

Bank Accounts in Mygate ERP

Committees can configure all society bank accounts within the ERP. For each account, admins record:

- Bank name and branch

- Account number and IFSC code

- Ledger linkage for accounting

- Transaction modes supported (NEFT, RTGS, cheque, UPI)

When expenses are paid, Mygate automatically records which bank account the money came from. This is critical for societies that operate multiple accounts, for example one for maintenance and another for sinking funds.

Reconciliation process

The reconciliation workflow ensures that vendor payments in the ERP match actual transactions in the bank:

- Import statement: Bank statements are uploaded in Excel or CSV format.

- Auto-match: The system attempts to match transactions based on amount, reference number, or vendor.

- Unmatched items: Payments that cannot be matched are flagged for manual review.

- Manual resolution: Admins link unmatched entries to the correct vendor payment or mark them as non-society transactions.

Every reconciliation action is logged with user details, ensuring transparency in case of disputes.

Audit Trail

Expense management is one of the most closely scrutinized areas during audits. Mygate ERP creates a complete audit trail for every expense:

- Vendor creation log: Who added the vendor, when, and what details were entered.

- Purchase request approvals: Full chain of who approved and who rejected.

- Expense booking details: Linked PO, MRN, bill number, ledger and amount.

- Payment log: Method, date, reference number and approving authority.

- Debit notes and adjustments: Reasons, dates, and authorized users.

- Reconciliation record: Who matched each payment and when.

At year-end, committees can generate a consolidated audit export covering vendor bills, payments, debit notes, approvals and reconciliation logs. This makes audits smoother and reduces back-and-forth between auditors and the committee.

Why this stage matters

Reconciliation and audit trails ensure committees do not just spend money, but also demonstrate control over how it was spent. With every expense linked to a vendor, PO, MRN, bill and payment, and with bank statements reconciled regularly, there is little scope for disputes. Residents gain confidence that funds are being handled with professionalism, and auditors see a complete record without gaps.

Why a runbook is needed

Expense management touches many hands — staff who raise requests, committee members who approve, treasurers who pay, and auditors who review. Without a structured routine, things slip. Bills pile up, approvals are missed, or vendor disputes drag on. A runbook keeps the process disciplined and ensures every stakeholder knows their responsibility.

Day-to-day practices

- Vendor validation: Check new vendors for GSTIN, PAN and bank details before adding them to the master.

- Purchase requests: Encourage staff to raise requests through ERP rather than informal channels.

- Approvals: Clear pending approvals daily so requests don’t clog the system.

- Expense booking: Enter bills promptly and attach supporting documents.

Monthly cycle

Reconcile payments

- Import the latest bank statement.

- Resolve unmatched transactions.

- Verify vendor account balances match ERP records.

Review budgets

- Compare actual spend vs budget head.

- Flag overspending heads to the committee.

- Re-allocate if necessary.

Vendor statements

- Generate and share account statements with major vendors.

- Resolve disputes before they escalate.

Audit logs

- Export discount registers, debit notes and approvals for record-keeping.

Year-end checklist

- Close all open POs and MRNs.

- Convert provisional penalties or advances into final entries.

- Generate a complete audit pack with expense bookings, payments, reconciliations, debit notes, and approval logs.

- Archive budget vs actual reports for the financial year.

Best practices for committees

-

- Use multi-level approvals for high-value bills to spread accountability.

- Link every bill to a PO or MRN to prevent phantom expenses.

- Tag expenses for projects and events so reporting is more meaningful.

- Run bulk uploads for recurring bills like security and housekeeping instead of booking manually.

- Reconcile weekly instead of waiting till month-end to avoid heavy backlogs.

- Keep audit exports in a shared digital folder accessible to the incoming committee.

Why discipline matters

Residents rarely see the details of how vendors are paid, but they feel the results when services stop because of delayed payments or when budgets are overshot. A disciplined expense management routine ensures services run smoothly, vendors remain satisfied, and financial records stay audit-ready. Mygate ERP gives the tools, but only committees that follow a consistent runbook get the full benefit.